This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Success Stories: Say on Pay Turnarounds

July 11, 2013

It’s hard to believe we are more than halfway through the 2013 proxy season and well into the third year of Say on Pay. Recently, the Wall Street Journal’s CFO Network section included an interview with three respected pros in the area of Corporate Governance: Pat McGurn, Nell Minow and Lynn Turner on “The Empowered Shareholder.” The question was, “What role do activist shareholders play in challenging how corporations are run?” The article ended with Mr. Turner explaining how critical it is for companies to know who their top ten investors are and make sure they communicate with them on a regular basis—so when you hit the rough spots they are willing to give you the time to work through it. Conversely, Mr. Turner said that “if you hit a rough patch and this is the first time your investors have heard from you, you are going to have a tough time.”

We can all agree that the old disconnects like tax gross-ups, single trigger change in control, and evergreen employment agreements are, for the most part, fading into the background. What this means is that investors are now laser focused on pay for performance alignment. In 2010, before Dodd-Frank became law, I published Fair Pay, Fair Play: Aligning Executive Performance and Pay, for which I developed a proprietary methodology to look at pay for performance alignment across the S&P 1500. This led to the creation of Farient Information Services and our proprietary database that now covers the Russell 3000. My colleagues and I have not only been following the Say on Pay (SOP) pass/fail rate of companies over the past three years, we also have been tracking companies that either fail or receive only a 50-80% yes Say on Pay vote. Further, we’ve been tracking which of these companies received a less than 80% vote due to pay for performance alignment issues.

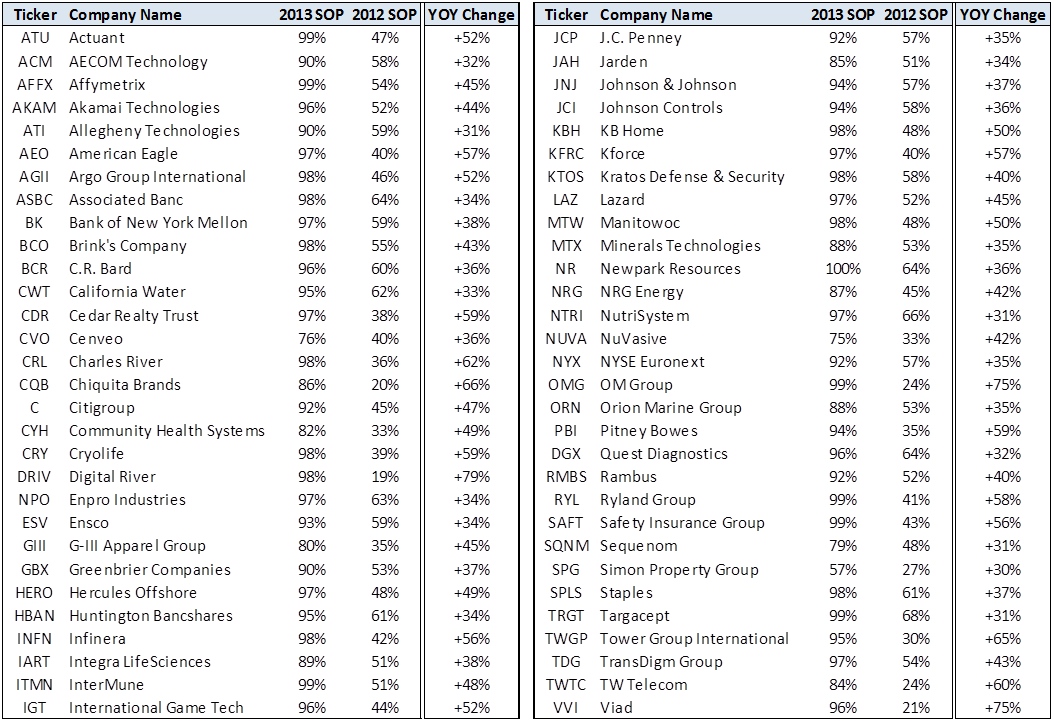

Since several of the largest public pension and mutual funds now subscribe to our Performance Alignment Reports, I have many opportunities to talk with shareholders about executive pay, corporate governance and the differences between the companies that “get it” and those that don’t. Granted, it’s easy to grab a headline or two writing about the companies that don’t get it — although only three companies have actually failed their SOP vote for all of the last three years (Tutor Perini, Kilroy Realty, and Nabors Industries). What I thought would be interesting is to focus on a few companies that are really getting it right—those companies that received a very low or a failed vote last year, and then turned it around in 2013. Not surprisingly, there were over 60 companies across multiple industries that took Say on Pay seriously (see the chart included below that lists the companies with the largest change in SOP results in 2013 versus 2012). Farient research has shown that many companies have made substantial reforms to their pay programs, allowing them to improve their overall SOP votes. These companies worked diligently over the past year to make meaningful changes to their pay programs and to communicate those changes to investors. I have outlined below a sampling of companies that I would nominate to the Say on Pay Hall of Fame (if there were one) for doing the right things and turning around their SOP votes in 2013.

OM Group — After receiving what was described as an unacceptable 24% SOP vote in 2012, OM Group took decisive action to ensure a significantly better vote in 2013. To better align pay and performance, OM Group redesigned its compensation program to: (1) better match its strategy of moving toward high value-added businesses and away from commodity-based businesses; and (2) achieve better alignment with investor interests. In particular, OM Group’s changes included: (1) developing a peer group that is more appropriate to the company’s new business model; (2) size-adjusting the competitive pay levels for pay benchmarking; (3) eliminating time-vested restricted stock units, making way for a heavier mix of performance-based long-term incentives (i.e., performance shares and stock options); (4) using performance measures in the incentive plans that have the most significant impact on shareholder value (i.e., operating income growth, return on net assets (RONA), relative total shareholder return (TSR), and strategic goals); and (5) adopting a clawback policy which conforms to the intent of Dodd-Frank.

OM Group’s decisive action in responding to investor concerns was embraced by shareholders, resulting in a 99% Say on Pay vote for 2013.

Quest Diagnostics – With its 2012 Say on Pay vote barely passing at 64%, Quest Diagnostics reevaluated its pay program, implemented changes, engaged shareholders and saw its 2013 Say on Pay vote move the needle with a 96% vote. The company rebalanced the mix of awards in its equity program to increase the portion allocated to PSUs and stock options, and decreased the percentage allocated to restricted share units (RSUs). Quest’s annual equity awards now consist of 40% stock options, 40% PSUs and 20% RSUs. The PSUs are earned based on a 3-year performance period that measure both returns and revenue growth (equally weighted), which the company believes are better aligned with shareholder value than its previous measure (operating income). In 2012, the company reduced the value of equity awards for its Named Executive Officers (with the exception of those for its newly hired CEO and President who joined the company in 2012) for a second consecutive year. The company implemented the reduction based on its annual review of competitive pay practices in keeping with the company’s executive pay philosophy.

Johnson & Johnson (J&J) — J&J had a number of missteps in 2012 and its Say on Pay vote paid dearly, barely passing with 57%. By the company’s own admission in its 2013 proxy, the 2012 Say on Pay results were below what it deemed as satisfactory. Like the other companies profiled here, J&J’s Compensation & Benefits Committee Chair and presiding Director and key members of management, met with a diverse mix of institutional investors and leading proxy advisory services to discuss the company’s executive compensation program and better understand the underlying reasons for last year’s poor Say on Pay results. Engaging shareholders and following through on addressing their concerns resulted in a very respectable 94% Say on Pay vote in 2013. With a new CEO in place, and the past executive compensation transgressions slowly going away, J&J revamped its disclosure, providing key compensation highlights in an easy-to-read, easy-to-digest executive summary in its proxy. Shareholders responded favorably to the key compensation overview narrative which summarized the changes, including: (1) revised pay for the new CEO to a more appropriate level; (2) reduced target annual performance bonuses for all NEOs by 10%; (3) eliminated above median target pay positioning for executive officers; (4) eliminated all-non relocation tax-gross-ups; (5) implemented a new long- term incentive program, i.e., PSUs with payouts contingent on the achievement of specific financial goals; (6) revised stock ownership guidelines to increase the amount of company stock the CEO must own to six times base pay; (7) added share retention requirements; and (8) implemented a clawback policy.

For the past three years, shareholders from some of the largest public pension and mutual funds have told me (and continue to tell me) that executive compensation is a window into the boardroom. If there is a problem with executive pay, it is likely that there are corporate governance issues in other areas. Most shareholders don’t want to be in the boardroom, but they do want clarity around executive compensation programs. If a company passes a SOP vote in one year, there is no guarantee that it will pass the following year. There are no guarantees. Semper vigilantissimi!

______________________________

Robin A. Ferracone is the Chief Executive Officer of Farient Advisors LLC, an independent executive compensation and performance advisory firm which helps clients make performance-enhancing, defensible decisions that are in the best interests of their shareholders. Robin Ferracone is the author of the book “Fair Pay, Fair Play: Aligning Executive Performance and Pay,” which explores how companies can achieve better performance and pay alignment. Click here to access Farient’s Weekly Pay Tracker and “Spotlight” company of the week. Robin can be contacted at robin.ferracone@localhost

Companies with Largest Change in SOP Results 2013 vs. 2012

© 2024 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media