FTSE 100 CEO Succession: The Price of Choosing the Right Leader

April 7, 2025

Nothing is more critical for Boards than selecting the right CEO to drive long-term success. While succession planning is a key part of the equation, there are times when looking outside of the organisation is necessary. Our latest findings highlight significant differences in remuneration practices between internal and external CEO appointments across the FTSE 100. We also examine the cost implications of external hires versus internal promotions and how investor pressure has unintentionally shaped these practices over time, offering valuable insights for Boards navigating these decisions.

Promoting from Within: Rewarding Loyalty

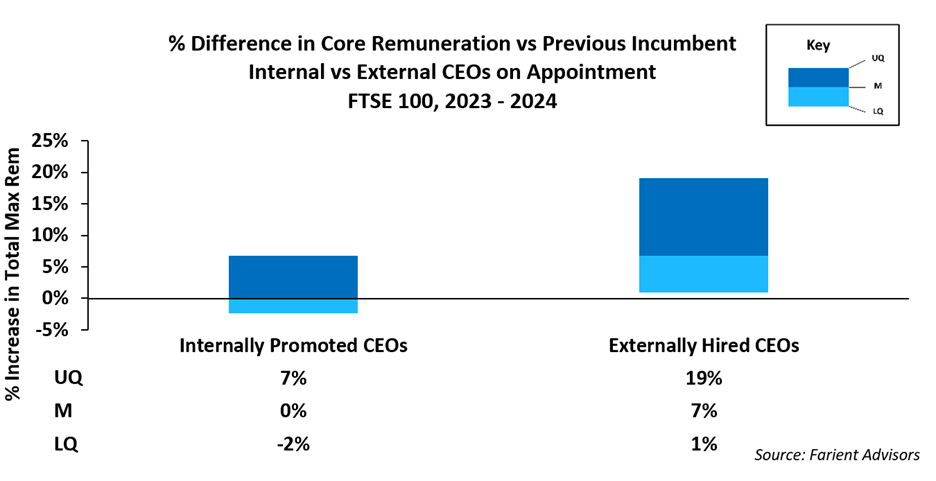

Boards are increasingly reluctant to start an internally promoted CEO on less than the incumbent due to the perceived (and in some cases real) investor pushback on catch-up pay increases in future years. As a result, median practice now sees internal promotions starting on the same level as their predecessors, despite in most cases having no prior experience as CEO. This is a notable shift from a few years ago when internally promoted CEOs typically started on around 10% lower than their predecessors. Investors must be suffering from a case of “be careful what you wish for” by pushing pack on pay rises, they have inadvertently driven up starting salaries, with knock-on impacts on incentives and benefits thereby costing investors more.

That said, there is a wide range of outcomes. While most internal promotions align closely with predecessor pay, cases ranged from a 40% cut to a 50% increase. Note that the 50% increase came from the Board correcting a situation where the founder had an abnormally low pay package, a move that Boards are becoming more proactive in addressing. Conversely, the 40% involved a NED stepping into the CEO role, where the predecessor’s pay was seen as inflated.

External Hires: The Cost of Outside Talent

When Boards look outside the organisation for leadership, the cost rises significantly. Our findings showed the median salary increase for externally appointed CEOs over the past two years was 7%, a clear premium. In every case over the past two years, external CEO hires were brought in at pay levels matching or surpassing their predecessor’s.

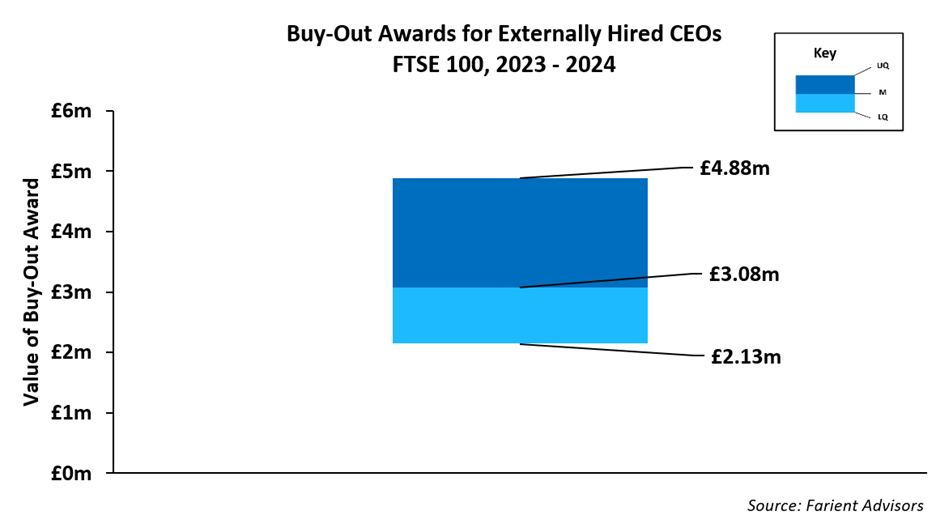

In addition to increased direct remuneration, hiring externally can incur significant extra costs. In the past two years, the largest buyout payment in the FTSE 100 reached £7.5m, while the median was £3.1m. In the US however, the largest buyout last year reached a staggering $90m (Starbucks), while the median value of in-flight awards for CEOs was $40m in the S&P 100, or $25m in the S&P 500. Similarly, there are clear differences in CEO succession either side of the pond. In the UK, 60% of CEO appointments were internal promotions, whereas in the US the figure was higher at 75%, reflecting the considerable costs of external recruits in the US market.

Despite these differences, UK practices are gradually aligning with US standards. In one case, a company listed in the FTSE 100 at the time of appointing a new CEO opted for a recruitment award instead of simply compensating for forfeited earnings, reflecting a shift towards US style arrangements. As the UK increasingly mirrors US practices, we expect these types of arrangements to become more common.

Farient’s View

CEO succession is a high-stakes decision with far-reaching consequences. Boards must prioritise finding the right candidate, ensuring the decision is not primarily cost-driven, while still navigating the competing demands of market competitiveness and stakeholder expectations. Whether promoting from within or hiring externally, the key lies in strategic planning, robust benchmarking, and sound governance.

By understanding the trade-offs and leveraging data-driven insights, Boards can make decisions that align with their organisational objectives, while managing the rising costs of leadership transitions.

Farient works closely with Boards and Remuneration Committees to ensure CEO succession is aligned with the company’s strategic goals, governance requirements, and stakeholder expectations. We partner with clients to navigate the complexities of succession planning, helping to position the Board’s preferred candidate for success.

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media