Executive Remuneration in Times of Uncertainty

April 11, 2025

Uncertainty has seemingly become the new norm. In recent years, Boards of Directors have had to navigate significant disruption brought about by a global pandemic, the war in Ukraine, and the resulting supply chain disruption and cost-of-living crisis. However, even these have been surpassed by the uncertainty of recent months.

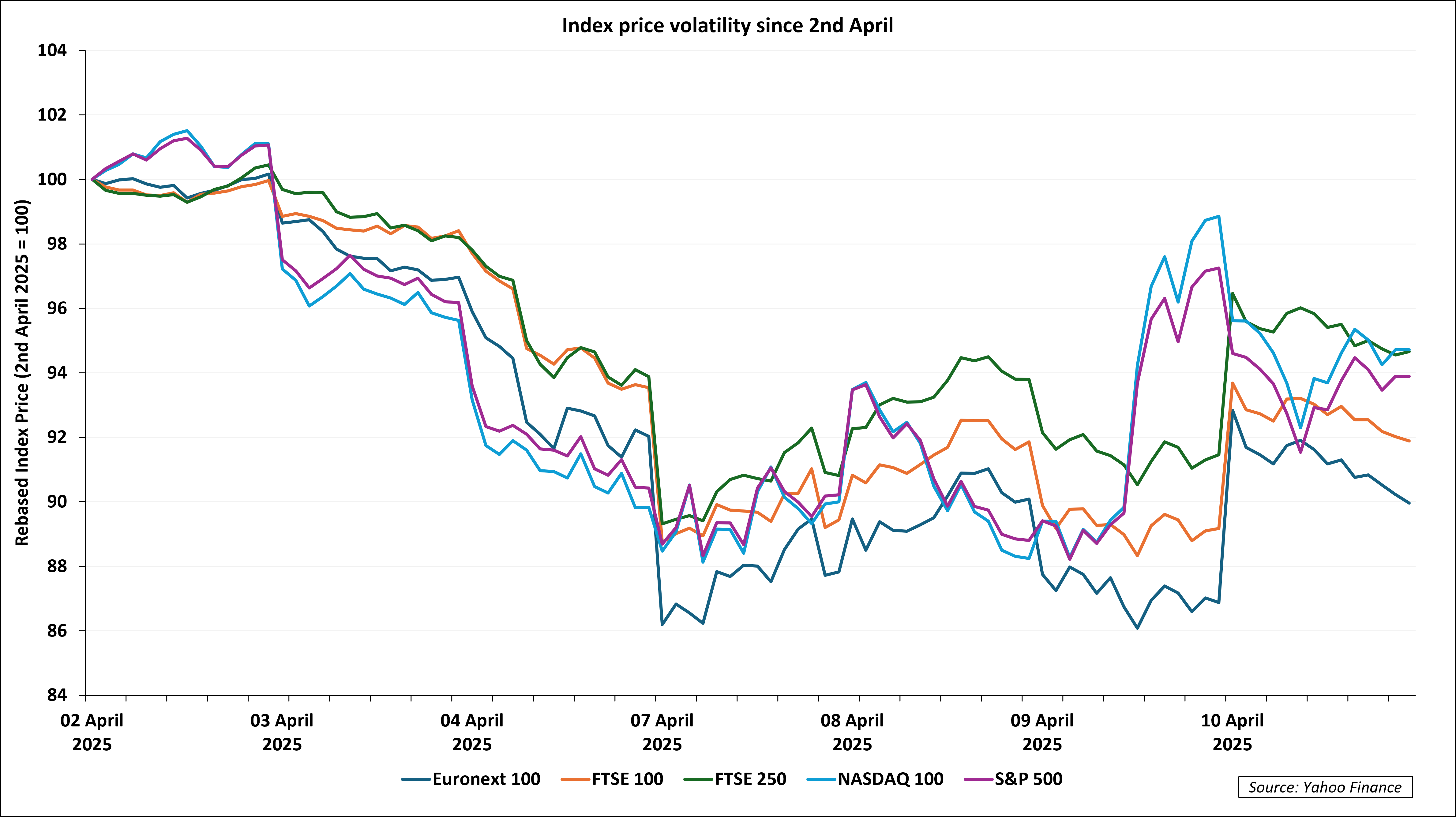

On 2 April 2025, President Trump announced sweeping tariffs, stoking fears of a trade war that could ultimately result in a recession across multiple economies. Since the announcement, stock markets across the globe have experienced significant volatility as investors attempt to understand how long these tariffs may be in place and how governments around the world will respond.

The stock market rebound to the 90-day pause announced on 9 April 2025 shows just how sensitive companies are to these changes – and it seems reasonable to assume this level of volatility could persist.

Against that backdrop, Remuneration Committees will need to think through the impact this uncertainty will have on remuneration, particularly for executive directors and other senior management.

Stakeholder Experience

Remuneration Committees are required to seek alignment between executive pay and the wider stakeholder experience. This was a common theme during COVID-19, as shareholders and proxy agencies held Remuneration Committees to account when pay decisions did not match the stakeholder experience. For example, paying executive bonuses where furlough money was accepted or dividends cancelled resulted in significant shareholder dissent.

Shareholders and employees will not be immune to the impacts of the tariffs. If a trade war erupts, we will likely see share prices fall further, affecting the value of shareholder portfolios and funds worldwide. In addition, economic slowdowns generally result in redundancies and increased unemployment.

Remuneration Committees will need to remain aware of this point as they seek to make the decisions referenced below. However, given the broader debate around the competitiveness of the UK market, we expect that Remuneration Committees will be spending a significant amount of time weighing the best approach whilst balancing the needs to effectively incentivise, retain, and motivate key employees and align outcomes with the stakeholder experience.

Incentive Outturns and Retention

Before the tariff announcement, most companies had set their annual bonus and long-term incentive plan (LTIP) targets for the year. Given the impact tariffs could have on the financial performance of companies, particularly those with significant sales in the US, the targets set may no longer be considered achievable.

In addition, for companies with LTIPs, there are potentially three in-flight awards that could be severely impacted, adding extra pressure to retain key personnel. At a time where there is extreme competition for top talent globally, we expect that Remuneration Committees will be considering how to retain their senior personnel and whether discretion can be exercised to remove the impact of the tariffs on performance.

For key employees below the board, we expect the exercise of positive discretion to be common. However, due to public scrutiny, exercising positive discretion for executive directors will remain challenging. Based on early discussions with institutional shareholders, we understand the starting position will be that discretion should not be exercised to remove the impact of tariffs on executive directors. This was the same position taken during COVID-19 and reflects the desire to see alignment between pay outcomes and the stakeholder experience.

It remains to be seen whether the debate around the competitiveness of the UK market will shift the approach taken. However, we still expect an exercise of positive discretion to be scrutinised by shareholders and proxy agencies.

Our view is that Remuneration Committees should take a proactive approach. Where targets recently set are no longer considered achievable, they should exercise discretion now rather than wait for the end of the performance period. While proactive changes [could] still be considered as an exercise of discretion, our view is making that change before the end of the performance period provides a stronger platform for defending the decision as a matter of judgement.

For companies with restricted share or hybrid plans, retention concerns will not be as significant. As noted in our Top Five Predictions for 2025 article released at the start of the year, we expect hybrid incentive plans will be on the agenda of many Remuneration Committees when undertaking their next Policy review. The retentive aspect of these plans will be particularly attractive given the current economic uncertainty. Therefore, we continue to believe there will be increased adoption of hybrid incentive plans going forward.

Setting Forward-Looking Incentive Targets

For companies that have yet to set their annual bonus and LTIP targets (or for companies revisiting those targets), the target-setting process will likely be significantly more challenging this year. The uncertain outlook for the economy may mean any budgets set for the year may need to be revised as the implementation of tariffs develops over the course of the year.

Given the increased uncertainty, we expect Remuneration Committees to set wider target ranges, particularly for threshold performance across both annual bonus and LTIP schemes. We expect this will be a sensible approach adopted by most of the market.

However, depending on the scale of disruption and for companies particularly impacted by the tariffs, our view is that Remuneration Committees could consider setting H1 and H2 targets for annual bonuses. This approach was adopted by many companies across both the UK and US markets during COVID-19 and would provide companies with additional flexibility as the scale and impacts of the tariffs become clearer.

The precise targets set will depend on your specific circumstances and the level of potential disruption tariffs may have for your industry. For example, companies operating in car manufacturing or steel production industries may expect more significant disruption because of higher tariffs.

Windfall gains

As noted above, the tariffs announcement has had a significant impact on share prices. This volatility will likely lead to consideration of potential windfall gains, where executives are seen to benefit from a market rebound rather than factors within their control.

In the UK market, the shareholder view is that windfall gains should be a consideration where the share price has fallen by around 20% – 25% from the price used to determine the previous LTIP grant. Where the share price has fallen by that amount, the rule of thumb is that the LTIP award should be reduced by half the share price fall. For example, where the share price has fallen by 20%, the LTIP grant size would be reduced by 10%.

During COVID-19, where windfall gains became a key theme, companies generally took one of two approaches:

1. Reduction made at the time of grant: Companies would reduce the size of the award at the time of grant to reflect the fall in share price. This approach was seen as best practice.

2. Commitment made to consider windfall gains at the point of vest: Rather than reducing the award at the time of grant, a commitment was made to consider windfall gains at the time of vesting and make a reduction at that point if deemed necessary, the most common approach.

Our view is that most companies will choose to adopt the second approach unless there is a more significant impact on their share price due to the tariffs.

Key Takeaways

The current economic uncertainty will place the spotlight on decisions made by Remuneration Committees and therefore it is important that a proactive approach is taken. We expect Remuneration Committees to consider the following:

1. Revisit targets for the annual bonus and LTIP plans if possible, and widen the ranges – particularly at threshold

2. Consider the impact of current uncertainty on in-flight LTIPs and whether discretion is possible and appropriate. Given sensitivities, where discretion is considered necessary and appropriate, Remuneration Committees should consult with shareholders close to the year-end

3. Review the appropriateness of current remuneration policies and whether a hybrid incentive plan is a better fit given the economic uncertainty

Should you wish to discuss how recent events have impacted your specific circumstances, please contact either me (stephen.cahill@farient.com) or David Cohen (david.cohen@farient.com).

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media