Farient Calls for Overhaul of UK Remuneration Market

September 10, 2025

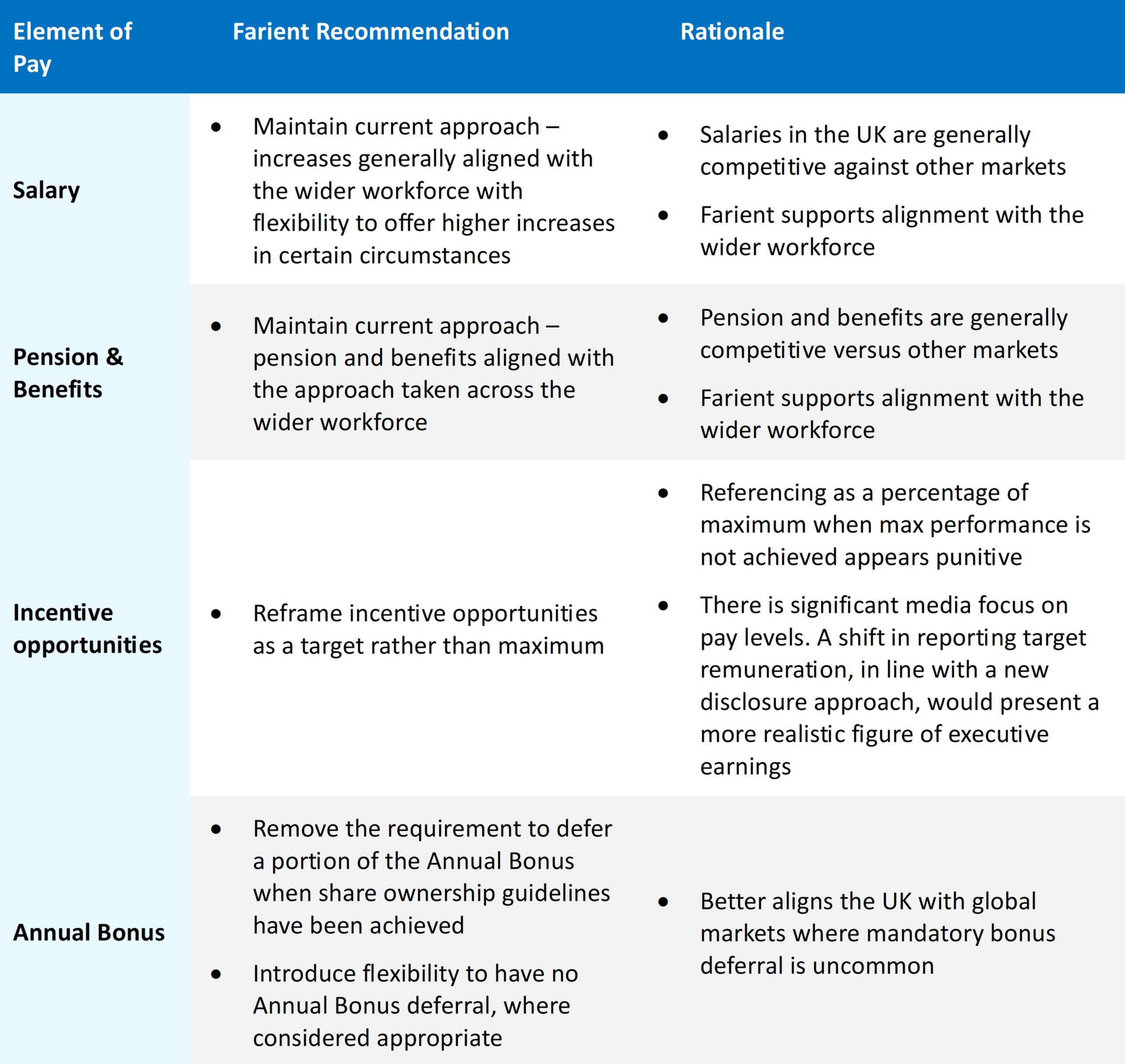

While not the sole factor, executive remuneration practices continue to impact the competitiveness of the UK market for executive talent and IPOs. Changes to date have been a positive step, but Farient believes that more significant structural modifications could further support UK efforts to become more globally competitive.

Farient believes the following changes would be a sensible development.

Remuneration Structure

- Remove the requirement to defer a portion of the Annual Bonus when share ownership guidelines have been achieved as a first step towards complete removal in time

- Increase flexibility within the long-term incentive plan (LTIP), including the use of market-value options with no performance conditions

- Remove the requirement to have a five-year time horizon between grant and release of LTIP

- Remove the post-employment share ownership requirement and increase the in-employment shareholding guidelines

- Reframe incentive opportunities as a target rather than a maximum

Governance Structure

- Removal of the Public Register

These changes may seem comprehensive but most are UK-only requirements. Even if all these ideas were implemented, the UK would still have one of the best remuneration governance arrangements in the world. The goal of these changes is to balance the UK’s approach to executive remuneration and ensure that the UK is (at best) attractive and in line with other markets.

This article provides the background and rationale for our thinking, including other ideas that may also be considered.

London’s Listing Collapse: Remuneration in Review

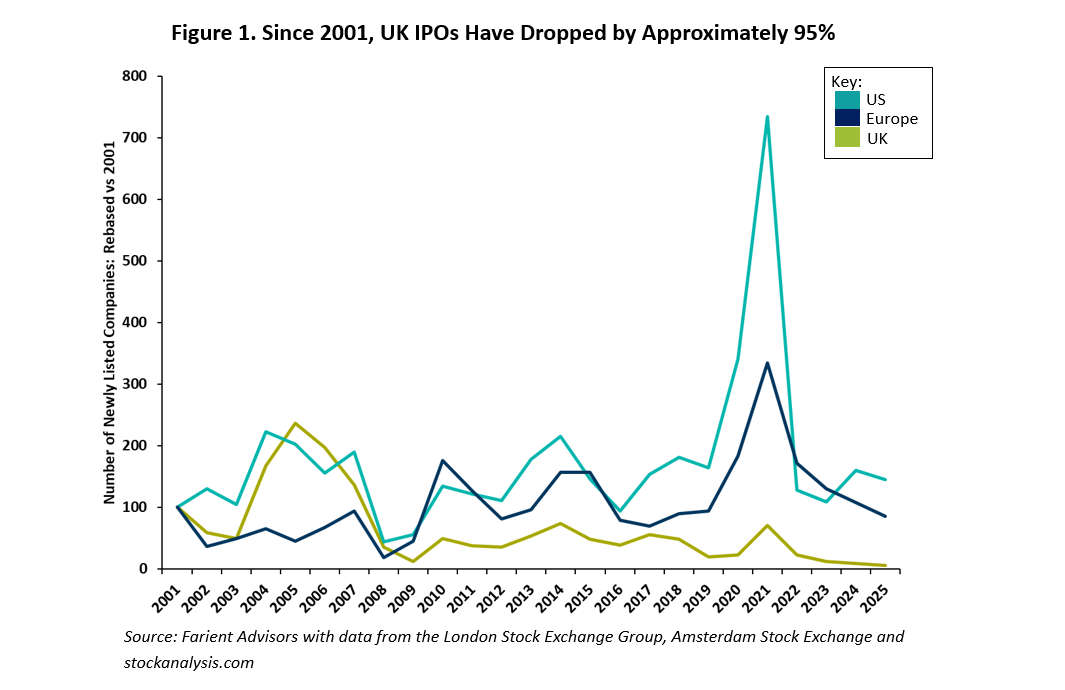

London is fast losing its edge as a competitive listing destination. In the first half of 2025, IPO fundraising in London plunged to its lowest level in 30 years. Figure 1 shows that the UK stands out as a clear outlier, with the number of initial public offerings on a downward trajectory over the last 25 years. Such trends signal a broader reality: market confidence in the UK continues to erode as it increasingly struggles to compete with international markets.

Not only is London seeing fewer new listings, but it’s also facing a growing exodus. A net 88 companies removed their primary listing from the UK last year, the highest number since 2009, the Financial Times has reported. This is because of companies moving their primary listing to other markets (primarily to the US) and a spate of acquisitions by both listed and private companies.

Overall, the number of companies with their primary listing on either the Main Market or AIM has fallen 20% since 2020.

The Competitiveness of UK Capital Markets

In addition to remuneration, other factors impact the UK’s competitiveness. These include:

- Governance and regulatory regime: The UK has one of the strongest governance regimes in the world, but it is often considered too rigid. For example, many founder-backed companies favour listing in the US due to the ability to implement a dual-class structure. While the UK Listing Rules have been reformed, the flexibility still falls short of other markets

- Stamp Duty Reserve Tax: This is a tax applied to electronic purchases of shares and securities in the UK, typically at a rate of 0.5% of the transaction value. Certain other markets, like those in the US and the Netherlands, do not have an equivalent tax

- Political uncertainty: Brexit introduced long-term political uncertainty and made London less attractive as a financial hub

- Gap in the price-to-earnings ratio: Perhaps linked to the other reasons noted above, UK-listed companies, on average, trade at a significant discount compared to US-listed companies. For example, companies in the FTSE 100 on average trade at a price-to-earnings ratio of approximately 17. This is significantly lower than companies on the S&P 500, which on average trade at a price-to-earnings ratio of approximately 27, per the Financial Times

The Changing UK Remuneration Landscape

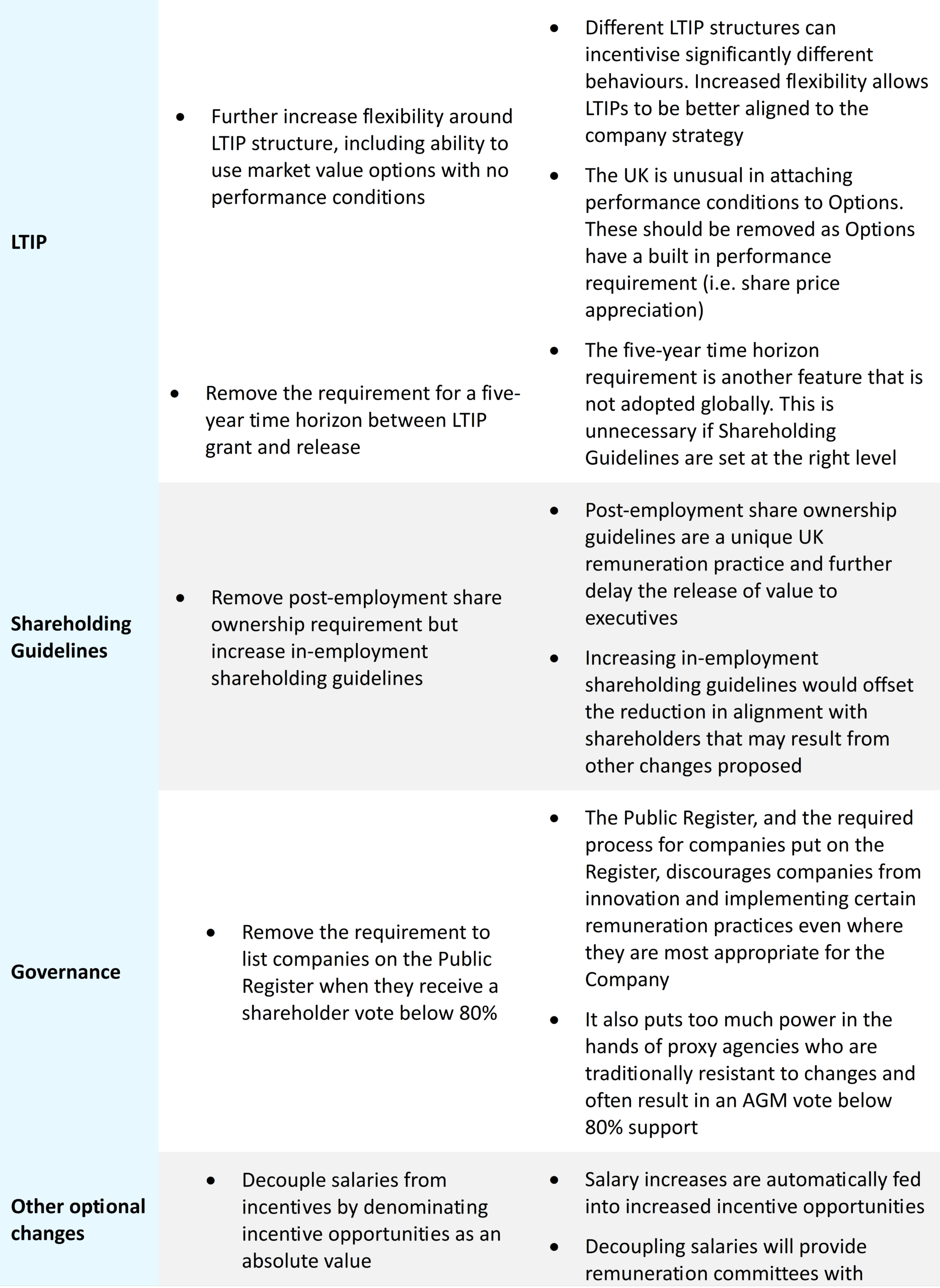

Remuneration is also seen as a key factor impacting the competitiveness of the UK market, which has been a key topic of discussion in recent years for Remuneration Committees. Many companies have noted difficulties competing for top talent in an increasingly global market, particularly against the US. While one of the big differences between markets is quantum of remuneration packages, this is not the only problem.

Structural differences have made the UK less attractive relative to other markets. This is particularly evident when comparing the UK to European markets, which have attracted more IPOs despite offering lower quantum levels in absolute terms.

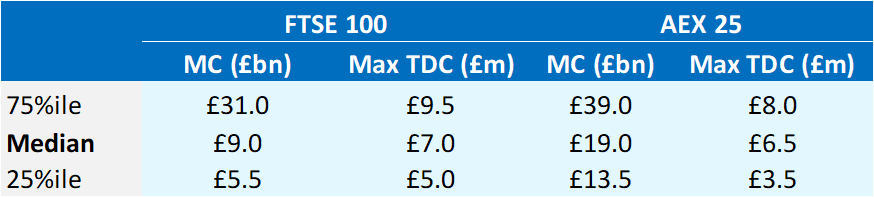

As shown in Figure 2, although AEX-listed companies offer lower maximum total direct compensation than those in the FTSE 100, several high-profile firms have still chosen Amsterdam over London. This reinforces the sentiment that the UK’s lack of competitiveness isn’t solely linked to absolute quantum.

For example, The Magnum Ice Cream Company chose Amsterdam as its primary listing location, although it is still planning on having additional listings in the UK and US. Similarly, CVC Capital Partners, a leading private markets manager, last year chose to list in Amsterdam, even though it has its roots and a major presence in London.

Figure 2. Market Cap and Max TDC: AEX 25 vs FTSE 100

Source: Market cap sourced from S&P Capital IQ, 09/09/25; Max TDC is collected from the latest Annual Reports of AEX and FTSE 100 companies

Further reflecting this debate, the Investment Association made significant changes to the latest edition of its Principles of Remuneration (“Principles”). The revised Principles encourage greater flexibility in remuneration approaches, with companies encouraged to consider what the most appropriate remuneration structure is to deliver long-term value creation. The revised Principles have been well received and have informed key trends seen in the UK market over the past AGM season:

- Quantum increases: Among FTSE 100 companies that have published their 2024 Annual Reports to date, 26 companies, or 84%, have proposed a quantum increase within their new Remuneration Policies. Of these, over half have increased quantum by more than 100% of salary

- Hybrid Long-Term Incentive Plans: Hybrid Long-Term Incentive Plans combine a restricted share element with a performance share element and is the most common incentive structure adopted by US-listed companies. This AGM season, nine companies introduced a hybrid scheme, up from six the previous year. Of these, eight combined the new hybrid structure with an increase in quantum

- Bespoke remuneration approaches: Companies are increasingly exploring more bespoke remuneration arrangements as they look to tailor their remuneration approach to their circumstances. For example, as part of the package to recruit a US-based individual, Burberry granted its incoming CEO a recruitment award equal to 300% of salary which will vest subject to share price performance. While common in the US, historically recruitment awards have not been adopted in the UK market

- Annual Bonus deferral: Approximately 25% of new Directors’ Remuneration Policies introduced flexibility to either reduce or remove the requirements to defer a portion of the Annual Bonus once executives meet their shareholding guidelines

The Future of Remuneration in the UK

As highlighted above, the changes made to date have been focused on addressing the quantum gap and some structural differences in remuneration, primarily versus the US market. While Farient considers the changes to be a positive step, they have remained within the construct of the current UK Corporate Governance Code/UK “Best Practice”.

More significant changes would require revisions to the UK Corporate Governance Code. Based on approaches seen in other markets, Farient has considered what changes could be made to the UK remuneration framework to increase competitiveness against the increasingly global market for talent.

Farient will monitor and report on market developments as the debate continues around the competitiveness of the UK market. With industry-leading experts in both the UK and US, and as a founding member of the Global Governance and Executive Group (GECN), Farient is well placed to provide companies with insights from across the globe. Should you wish to discuss our thoughts on the competitiveness of the UK market or your specific circumstances, please contact either myself (stephen.cahill@farient.com), David Cohen (david.cohen@farient.com) or Alex Styles-Morris (alex.styles-morris@farient.com)

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media