The Evolution of Target Setting

January 21, 2026

Driven by the ongoing debate around the competitiveness of the UK market, 2025 was a significant year of change in the UK executive remuneration landscape.

A key theme that emerged is significant quantum increases for companies putting their Directors’ Remuneration Policy (Policy) to a shareholder vote. In the Main Market, 75% of FTSE 100 firms and 50% of FTSE 250 companies reviewing their Policy increased incentives. Of those companies increasing quantum, over 60% of FTSE 100 companies and over 40% of FTSE 250 companies raised quantum by 100% of salary or more.

Incentive increases are expected to continue into the 2026 AGM, where up to 50% of FTSE 350 companies are expected to put a new Policy to shareholders.

Another key theme that emerged is an increase in incentive outcomes versus prior years. In the FTSE 100, median annual bonus (79% of maximum) and LTIP (75% of maximum) outturns both increased versus the prior year. This is a general trend that has occurred since the pandemic, where increased uncertainty likely led to potentially more achievable targets being set, and is significantly higher than the average outturns we generally expect for the annual bonus (60% – 70%) and long-term incentive plan (LTIP) [40% – 60%] over time.

As companies continue to raise incentive quantum over the coming years, Farient expects shareholders and proxy agencies to increasingly scrutinise pay for performance, the stretch of incentive targets, and the target-setting process.

Factors Considered When Setting Targets

Target setting is one of the most critical – and scrutinised – responsibilities of Remuneration Committees. While the precise target setting process will vary by company, there are several factors that Remuneration Committees commonly consider:

Factors for Remuneration Committees to consider when setting targets

Considerations for Remuneration Committees

With increased scrutiny on target setting, Remuneration Committees will face growing pressure to ensure incentive plans are both competitive and defensible. We have outlined four key considerations to help Remuneration Committees navigate this challenge.

1. Reframe Incentives Around Target, Not Maximum

In the UK listed market, performance against incentive plans is communicated in terms of maximum payout, which often creates a distorted perception of pay. Remuneration Committees could consider reframing incentives to be disclosed as a percentage of target rather than maximum for the following reasons:

- Psychological impact: Communicating incentives as a percentage of maximum means that any performance other than maximum feels like a takeaway from participants. Using a percentage of target approach means participants can achieve outturns above 100%, which may be more incentivising

- External optics: Target earnings are, on average, a more realistic indication of what an individual is likely to earn versus the maximum opportunity. Executive reward continues to attract significant media scrutiny, with headlines frequently quoting the maximum an individual can earn. Reframing incentives as a percentage of target may promote more accurate reporting of executive pay opportunity

- Global consistency: Many international markets, including the US, already frame incentives around target. Adopting this approach would therefore increase consistency with global practices

2. Setting Targets for Hybrid Plans

Hybrid structures, which typically combine performance share plans (PSPs) with restricted share plans (RSPs), are becoming the incentives of choice in the UK market. 50% of all new LTIP structures implemented in the FTSE 350 in 2025 involved moving to a hybrid approach. We expect this trend to accelerate in 2026 as Committees increasingly seek the retentive benefits of RSPs while allowing PSPs to focus on driving genuine outperformance.

Bolting on an RSP to a PSP changes the dynamics of an LTIP, since the RSP provides an almost guaranteed payout. This allows Remuneration Committees to ensure the PSP is focused on driving outperformance, rather than setting a threshold target at a level considered readily achievable to provide some retentive element. However, where a hybrid is implemented alongside an increase in quantum and the threshold target under the PSP is maintained, this could result in a significant increase in the level of vesting at threshold performance, which shareholders could challenge.

To counter this, there are two potential approaches that could be adopted by Remuneration Committees:

- Approach 1: Keep threshold vesting at the same % of maximum, but set a more challenging threshold target

- Approach 2: Reduce threshold vesting so that no additional payment is achieved for simply hitting threshold

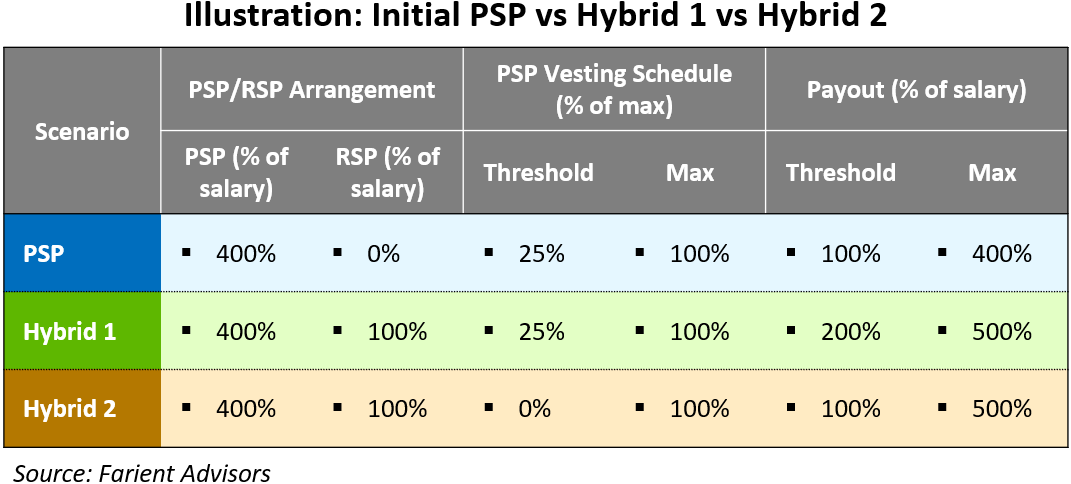

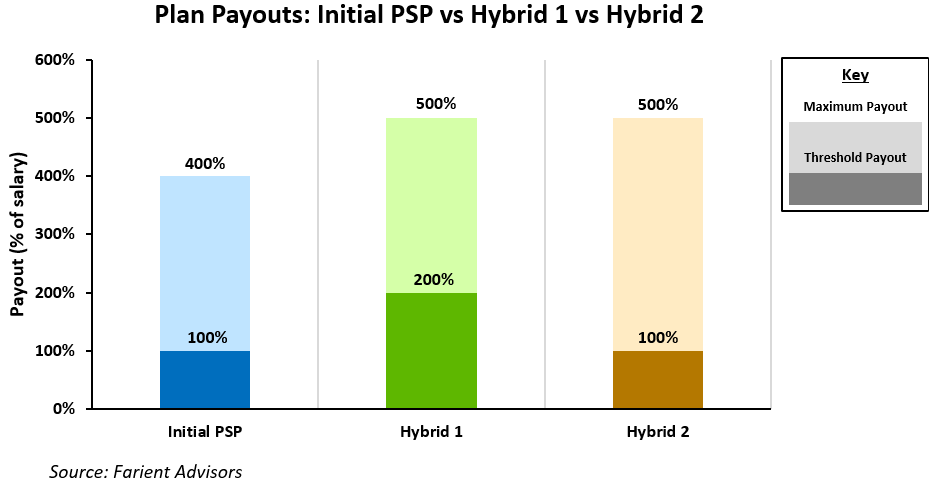

The illustrative example below demonstrates how Approach 2 would work in practice, where a 100% RSP award is made in addition to maintaining a 400% PSP. Hybrid 1 presents an example where no change is made to threshold vesting under the PSP, whilst Hybrid 2 assumes threshold vesting under the PSP is reduced to 0%.

As the chart above demonstrates, where no change is made to threshold vesting following the addition of an RSP worth 100% of salary (Hybrid 1), the overall outturn at threshold increases from 100% to 200% of salary. However, where threshold vesting is reduced to 0% (Hybrid 2), the overall outturn at threshold is maintained at 100% of salary.

3. Budget vs Industry Average

As noted above, budgeted performance over the relevant performance period is a key, and often primary, input into the target-setting process. While common practice, using budgets as the primary reference point can unintentionally penalise high-performing or highly efficient companies, as their efficiency may already be embedded into the budget. Setting targets based on the budget in this scenario may therefore not give the company and its management the credit they deserve for exceeding industry standards.

To address this, Committees should assess the balance between budget-based targets and typical stretch observed in the market. While not all performance measures lend themselves to external benchmarking (e.g. company-specific KPIs), Farient’s view is that there is scope when setting targets for companies to place more emphasis on typical market practice based on their industry.

Doing so requires careful positioning and a clear rationale for shareholders. Explaining why market-based calibration has been incorporated – and how it supports the alignment of pay and performance – will be critical to ensuring shareholders understand the approach and support the underlying targets. One way that companies could help embed this approach is to include a reference to industry averages as part of any external guidance issued (e.g. during a capital markets day, or similar). This would provide a public disclosure that could be referenced when explaining the approach in the relevant Directors’ Remuneration Report.

4. Ensure Appropriate Calibration of Non-Financial Measures

Non-financial measures, including those related to environmental, social, and governance (ESG) initiatives, continue to be adopted widely across the market and can be qualitative or quantitative in nature. Where these measures are aligned to the long-term strategy, they are typically accepted by shareholders. However, many shareholders perceive the target-setting process for these measures to be less rigorous and often easier to achieve than financial measures, given the sometimes higher payouts.

In the FTSE 350, the lower quartile CEO bonus outcome for non-financial measures in FY24 was 51% of maximum, compared to 37% for financial measures. This demonstrates the significantly higher payments seen against non-financial measures – with the lower quartile outturn showing above target achievement. Similarly, in the S&P 500, payouts for non-financial measures averaged 10% higher than financial measures, prompting shareholder scrutiny over whether these targets are sufficiently stretching. US institutional investors recently voiced this concern, noting that consistent above-target payouts for non-financial measures signal a lack of robustness in target setting, particularly for qualitative measures where subjective judgement is involved.

As quantum continues to increase in the UK, we expect shareholders to pay particular attention to non-financial target setting given the higher outturns against these types of measures.

Target setting can be a complex and challenging process that is likely to see further scrutiny from shareholders and proxies in the upcoming years as quantum continues to rise. Should you wish to discuss your specific circumstances, please contact Stephen Cahill (stephen.cahill@farient.com), David Cohen (david.cohen@farient.com), or Alex Styles-Morris (alex.styles-morris@farient.com).

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media