Study of PSUs Sees Higher Pay, Lower Performance

May 15, 2025

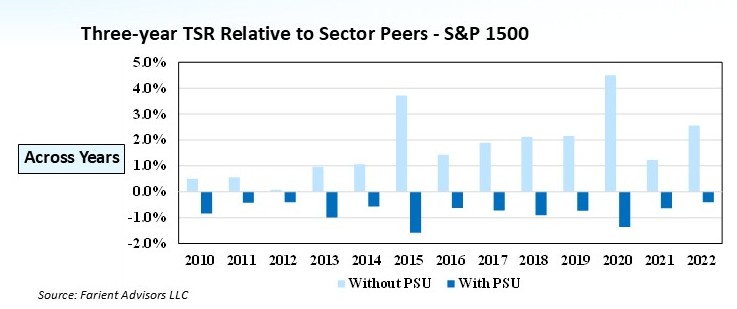

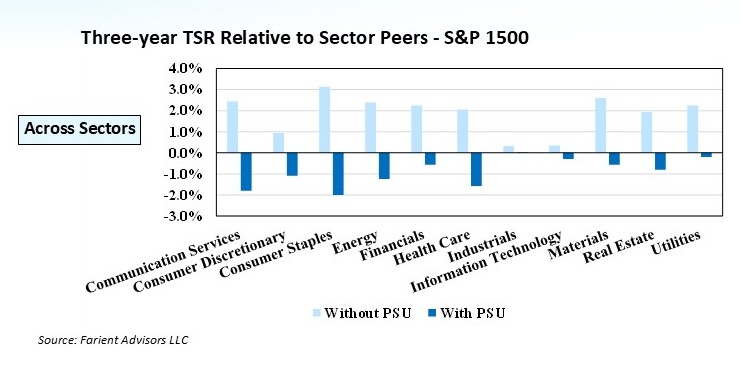

New research from Farient Advisors and the MIT Sloan School of Management finds that relative total shareholder return (TSR) is lower and compensation higher among S&P 1500 firms that award performance share units (PSUs) versus time-based equity awards, i.e., restricted stock units (RSUs) and stock options.

Today, 75 percent of S&P 1500 companies award PSUs in their long-term incentive plans (LTIPs). Farient analyzed LTIPs and TSRs among the S&P 1500 between 2008 and 2022, building on research with a 10-year time horizon published in 2019 by Farient Partner Marc Hodak.

Farient’s new research is detailed in an academic paper Hodak co-authored with MIT Sloan Prof. Andrew W. Lo and Postdoctoral Associate Chaoyi Zhao. Their findings “highlight the need for companies to reassess their reliance on PSUs and consider simpler, more transparent, and potentially lower-cost incentive structures that balance short-term and long-term goals while leveraging intrinsic motivation to drive sustainable value creation.”

Fresh Looks

Corporate America’s embrace of PSUs was kickstarted in 2005 when an accounting rule change required companies to expense stock options. Added pressure from investors and proxy advisors for companies to tamp down CEO compensation and link pay to performance accelerated the adoption of PSUs. Among the S&P 1500, the prevalence of PSUs has increased over the last 20 years from about 30 percent to 75 percent of companies.

In response to the Farient research, ISS has asked investors if it should continue viewing a >50% performance-based LTI mix as a positive factor in its qualitative pay for performance review or if it should also view time-based equity with extended vesting (e.g., of 5 to 7 years) as a positive factor. Similarly, Glass Lewis has asked investors whether time-based awards with extended vesting periods (e.g., 5+ years) should be considered acceptable. As of now, proxy advisors require a majority of PSUs in LTIPs as they sharpen their focus on plan design and goal rigor.

Big Risks, Big Rewards

There are numerous examples of CEOs recruited to top jobs with the promise of a big payday if they deliver. PSUs are often an important component of those compensation plans. A recent case in point is recently hired Intel CEO Lip-Bu Tan. His potential earnings could exceed $400 million, but only if he triples Intel’s stock price and outperforms the S&P 500. Vesting of Tan’s PSUs is based on Intel’s TSR relative to the TSR of the S&P 500 over three years.

In a recent interview with Fortune analyzing Tan’s compensation, Farient CEO Robin A. Ferracone emphasized the enormous task facing Intel’s new chief executive. Tan is not just executing a turnaround, Ferracone observed, but is “very nearly rebuilding the company.” In that same article, Farient Vice President and Chief Data Officer Eric Hoffmann underscored Tan’s pay package’s risk-reward nature, pointing out that Tan’s grants could fail to vest entirely without significant stock price appreciation.

Some companies forego PSUs altogether. Amazon is one example. It cited Farient’s research in its 2025 proxy statement that detailed its opposition to equity grants, writing: “We share the view expressed by the Council of Institutional Investors, Norges Bank Investment Management, and others that tying stock and cash award payouts to a handful of discrete performance criteria is a major source of complexity and confusion in executive pay and results in executive compensation arrangements that lack transparency since they are more difficult to value and more vulnerable to obfuscation than time-vesting restricted stock units, and often do not align with long-term performance.”

Farient’s View

As a firm, Farient has always advocated that pay should be closely linked to performance. While our research suggests that PSUs may not be the optimal way to create that linkage in all situations, we believe incentives must be tailored to each company’s strategy while being cognizant of proxy advisor standards.

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media