Distilling The SEC’s Landmark Climate Disclosure Proposal

April 13, 2022

The Securities and Exchange Commission (SEC) recently issued its much-anticipated proposed climate disclosure rules that would require public companies in financial statements to report their greenhouse gas (GHG) emissions, exposure to climate risks, and climate-related metrics.

The new rules are a significant step forward in standardizing public disclosures on environmental measures. There are currently various climate disclosure frameworks, which companies use voluntarily, making comparisons difficult. The SEC argues that its proposal would provide investors with consistent and comparable information, useful for making investment decisions.

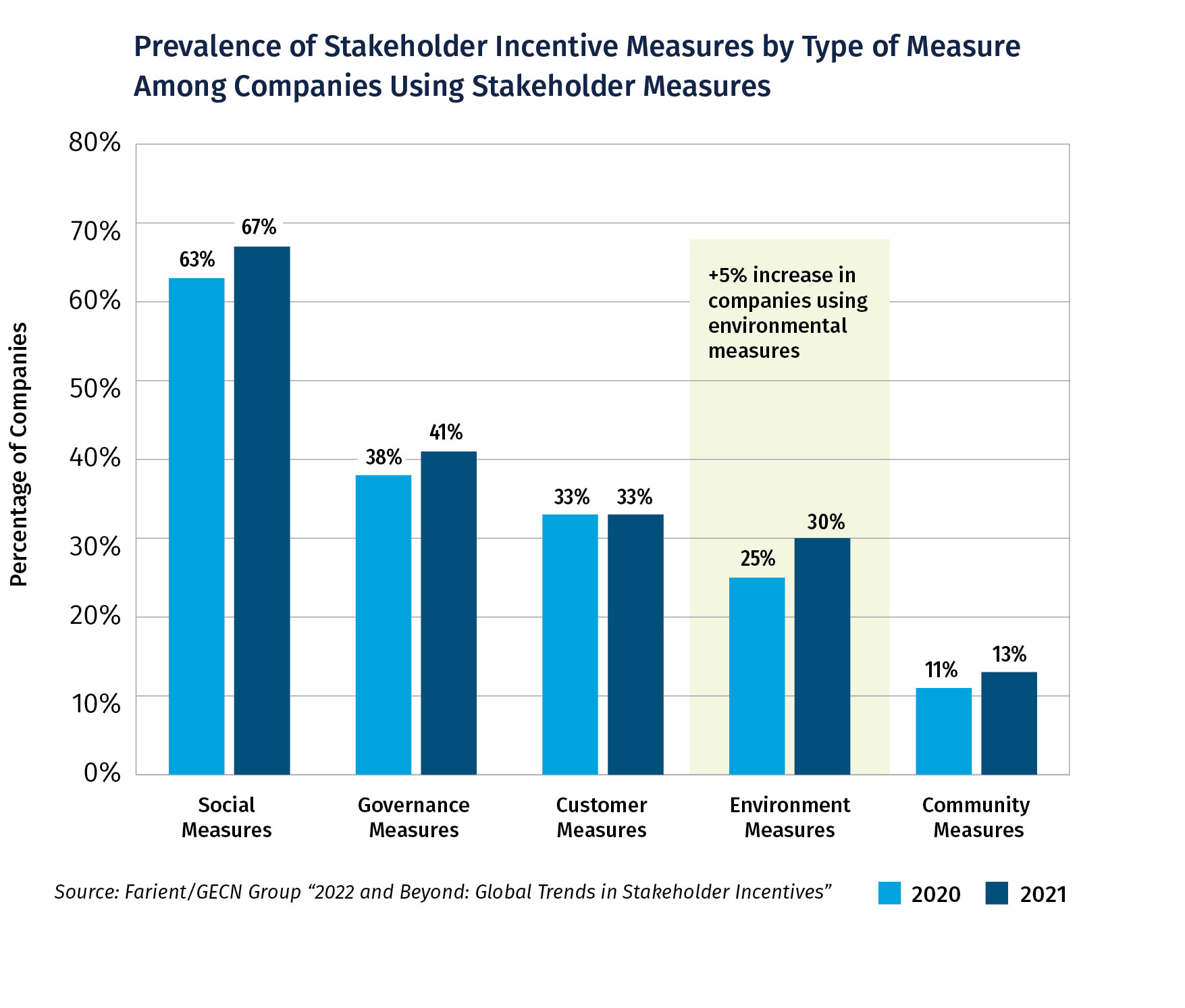

Investors, stakeholders, and shareholder activists are increasingly focusing on environmental issues, which has also led to a growing use of environmental metrics in executive incentive plans. These measures encourage executives to improve performance on GHG emissions, the use of renewable energy sources, and natural resources, among other items. Farient’s recent study, 2022 and Beyond: Global Trends in Stakeholder Incentives, highlights 30% of large companies around the world using environmental metrics in their incentive plans, and of those, approximately half are using some sort of GHG emissions measure.

Summary of Proposed Rule

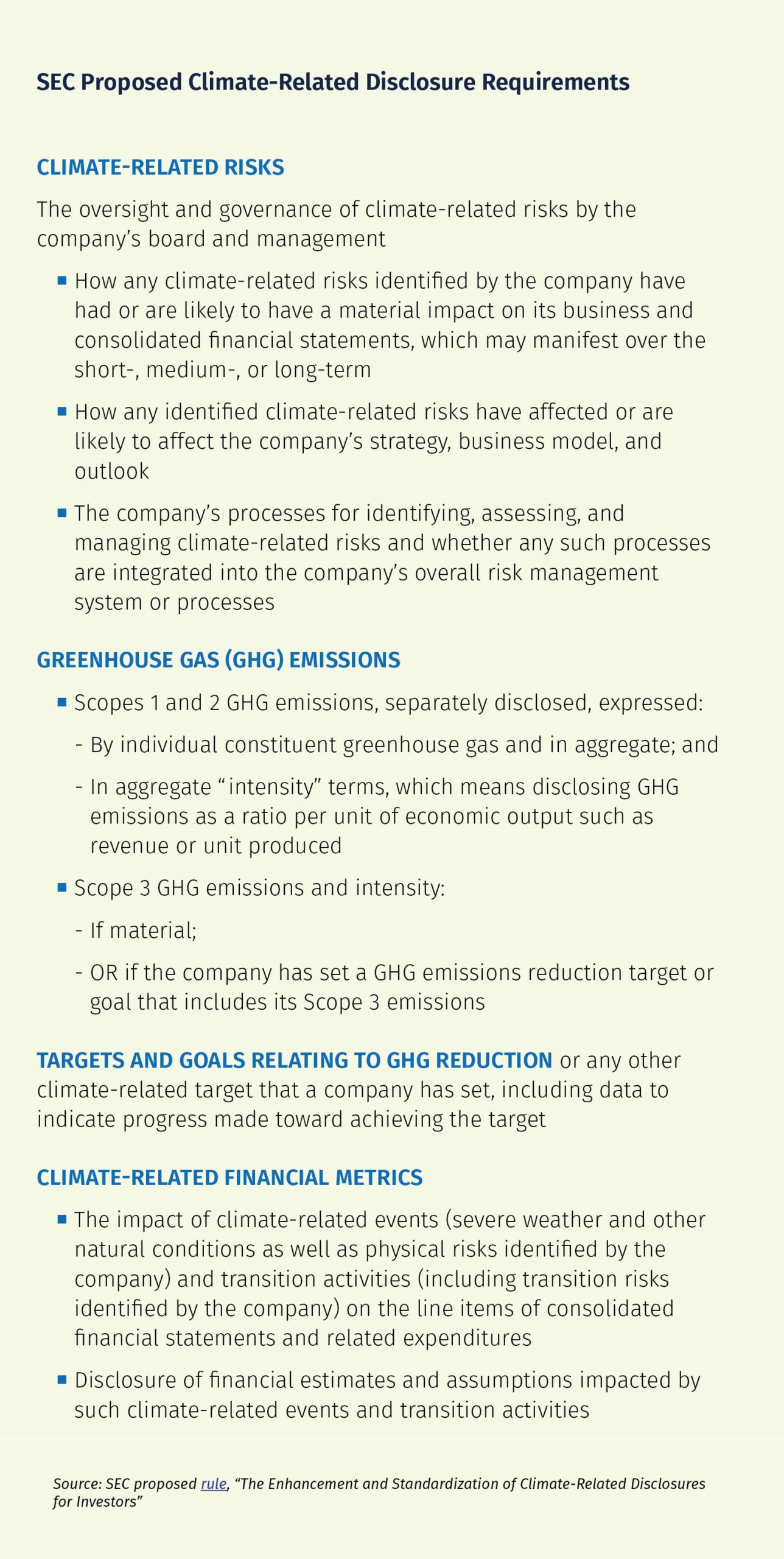

The proposed disclosure framework is modeled in part on recommendations from the Task Force on Climate-related Financial Disclosures (TCFD), and draws upon the GHG Protocol, which provides accounting and reporting standards on GHG emissions. The rules would require companies to disclose:

- Information on climate-related risks, including oversight processes and impacts on the company

- GHG emissions under Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (indirect emissions from upstream and downstream activities) methods

- Targets and goals on GHG reduction or other climate-related targets, including any progress made on achieving those goals

- The impact of climate-related events (e.g., severe weather) and the impact of activities for transitioning away from GHG emissions in the line items of their consolidated financial statements

Disclosures would be required in periodic reports (e.g., Form 10-K) and SEC registration documents (e.g., Form S-1), and are applicable to both domestic U.S. companies and non-U.S. companies registered with the SEC as “foreign private issuers.”

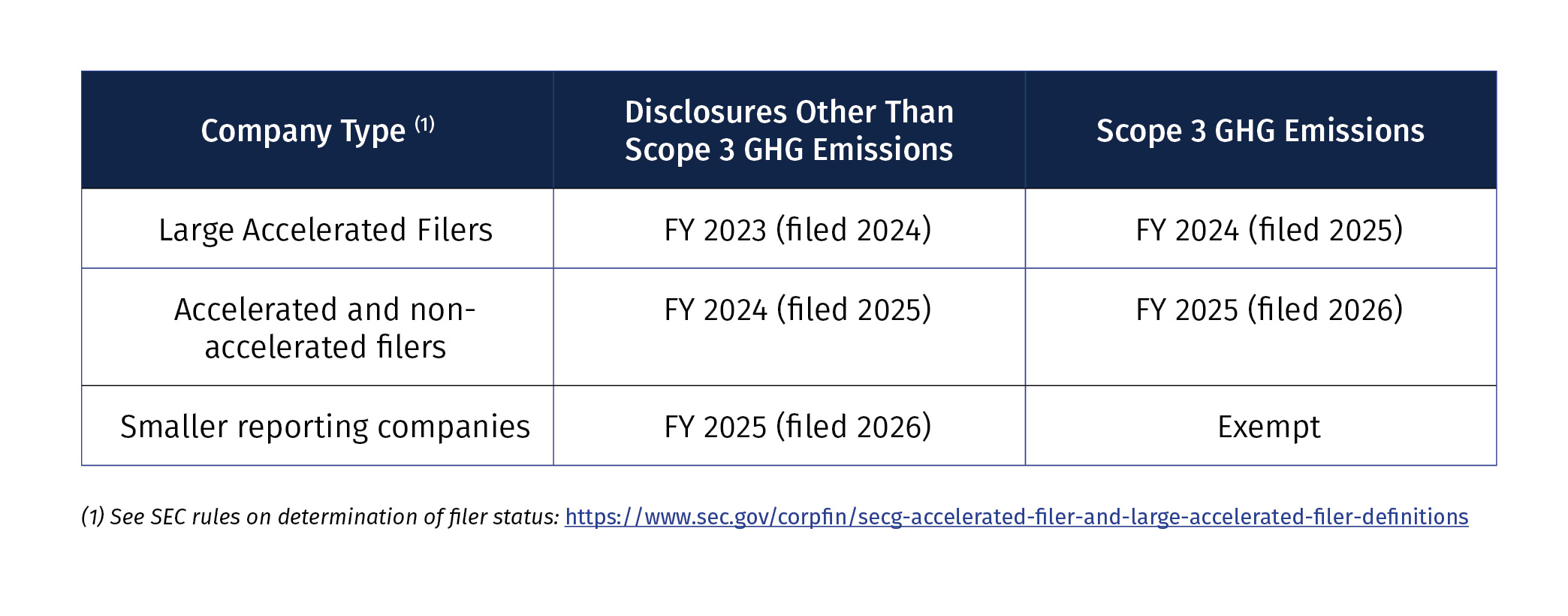

The rule would be phased in starting with the first full fiscal year following the effective date, with the compliance date dependent on the content of the item of disclosure and the company’s filer status. For example, if the effective date of the proposed rules occurs by December 2022, and a company has a calendar 2022 fiscal year end, the compliance date for the proposed disclosures in annual reports will be:

Companies subject to the proposed GHG Scope 3 disclosure requirements, which excludes smaller reporting companies, will have one additional year to comply with those disclosure requirements.

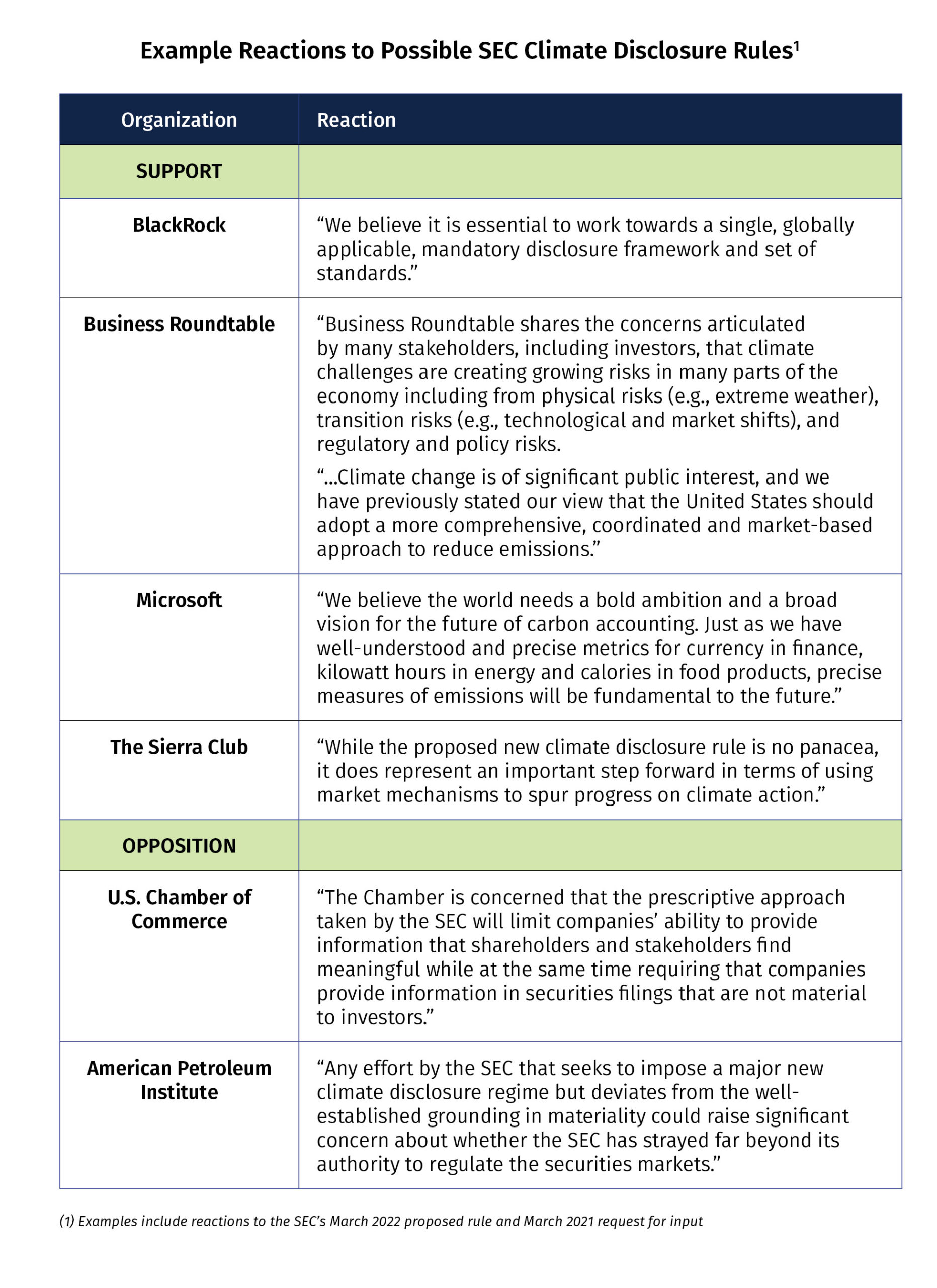

Reactions to the Rule

The reaction from the business community to the SEC’s proposed climate disclosure rule has been expectedly mixed. Large institutional investors, particularly those focused on sustainability and ESG investing, have welcomed the proposed rule, as it would help standardize disclosure that is currently voluntary. For those companies that disclose these areas, disclosure is currently inconsistent, which makes comparability difficult. Additionally, some large companies, many of whom already disclose GHG emissions under TCFD standards, have expressed support for the rule given broader environmental initiatives pursued across businesses and industries to address climate change.

On the other end of the spectrum, opposition to the rule has come from certain trade and business groups who argue, among other things, that: the SEC is exceeding its authority; the burden and cost of compliance is too high; and the required disclosure is immaterial to investors. Also, the inclusion of Scope 3 emissions disclosure, which are indirect emissions produced by a company’s upstream and downstream activities along its value chain, is controversial. The phased-in approach, liability safe harbor, and exemption for smaller reporting companies by the SEC is meant to assuage some of these concerns, but opposition remains.

Farient’s View

Assuming the rule is adopted, either in its current state or in a modified form, companies will need to determine the specific rules that are applicable to them. Additionally, companies will need to evaluate whether simply adhering to the minimum level of disclosure will be sufficient for their investors and stakeholders, or whether additional disclosures that go above and beyond the rule, such as setting GHG emission reduction targets, will be more appropriate.

Because the disclosure requirements likely will go into effect for many companies with their 2024 financial filings, this also is an opportune time for companies to evaluate whether ESG initiatives should be tied to their incentive plans. Companies are at differing stages in their sustainability/ESG journeys. Some companies still need to establish sustainability strategies and identify material metrics and appropriate goals, while others have already determined how climate fits into their strategies and have established climate-related measures, goals, and incentives.

We predict the proposed climate disclosure rule, assuming it is enacted, will hasten the ESG journey, and will serve as a catalyst toward putting quantitative climate-related goals into short- and long-term incentive plans. As investor pressure mounts, companies likely will intensify their efforts to review their climate-related strategies, putting them in a better position to incorporate these strategies into their incentives, if desired. In addition, because standardized disclosures will make it easier for companies to compare their performance with one another, we likely will see greater use of relative climate-related measures in incentives.

Overall, incentives related to environmental metrics are likely to continue to grow in prevalence and evolve quickly in character. This is one area on which companies should keep a close watch.

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media