Gensler’s SEC Approves Pay Versus Performance Disclosure

September 12, 2022

Amendment Takes a Prescriptive Approach to Rulemaking

The disclosure of linkage between executive compensation and financial performance is the thrust of a new pay versus performance disclosure rule approved on Thursday, August 25, by the U.S. Securities and Exchange Commission. In effect for the upcoming 2023 proxy season, the amendment will require companies to show what is paid to a company’s top executives and how that relates to financial performance. The final rules apply to fiscal years that end on or after Dec. 16, 2022, which means companies with a 2022 calendar year-end will need to comply with the new rule.

During the new rule’s phase-in period, companies will be required to provide three years of reporting in the first year, four years in the second year, and five years in the third year and thereafter. Smaller reporting companies (SRCs)—generally those with annual revenues of less than $100 million—will be required to report a minimum of two years in the first year and up to three years in subsequent annual filings.

The rule mandates that companies report their total shareholder return (TSR), the TSR of companies in their peer group, their net income, and a financial performance measure chosen by the company. In addition, companies will be required to describe the relationship between the executive compensation paid to the CEO, the three aforementioned financial performance measures, and the company’s TSR relative to that of its selected peer group. Companies also will be required to describe the relationship between the other named executive officers (NEOs) and these measures. This newly required information must be provided in both table and narrative formats.

“The Commission has long recognized the value to investors of information on executive compensation,” said SEC Chair Gary Gensler in a news release. “Today’s rule makes it easier for shareholders to assess a public company’s decision-making with respect to its executive compensation policies. I am pleased that the final rule provides for new, more flexible disclosures that allow companies to describe the performance measures it deems most important when determining what it pays executives.”

The 12-Year Path to How We Got Here

Outside of Say on Pay becoming mandatory for public companies in 2011, the pay versus performance rule is among the most anticipated executive compensation provisions stemming from the Dodd-Frank Wall Street Reform and Consumer Protection Act passed in 2010. It represents the determination of Gensler to take up rules that had been on the agency’s long-term regulatory agenda and had stalled under his predecessor, SEC Chair Jay Clayton.

A draft rule, released in 2015, received pushback from some companies and investors seeking more flexible reporting requirements. Critics of the pay versus performance rule, who expressed their concerns in comment letters to the Commission, alleged that the SEC did not sufficiently analyze the cost implications for companies. Another grievance was that the rule would not produce any major benefits or generate new underlying informational content not already covered in the Compensation Disclosure & Analysis (CD&A) section of the proxy.

The Commission voted 3-2 along party lines in adopting the final rule. In voting against the rule, Republican Commissioner Mark Uyeda said the SEC had failed to update stale data and provide adequate economic analysis while fellow Republican Commissioner Hester Peirce called the rule unnecessarily complicated and costly for companies to implement.

The Final Rule at a Glance

The final rule aims to provide greater transparency and better inform shareholders when voting on executive compensation plans and the election of Board Directors. Specifically, it:

- Requires a new table in the proxy, showing individual years’ total compensation as reported in the summary compensation table (SCT) versus a new definition of total compensation actually paid to the CEO and NEOs, as compared to various measures of company and peer (i.e., relative) performance

- Requires a description of the relationship between actual compensation and performance in a narrative or graphical presentation (or a combination of both)

- Requires a new tabular list of three to seven financial performance measures that are considered “most important” by the company in determining compensation actually paid to executives in the most recent year Non-financial measures (e.g., operational or ESG-related measures) may be listed in addition to the three required financial performance measures (see example below)

Rules are scaled back for smaller reporting companies, by requiring fewer years of disclosure and exemptions for particular data points (e.g., peer TSR), and rules exclude emerging growth companies, registered investment companies, and foreign private issuers.

Illustrative List of Potential Performance Measures

| Performance Measures |

| 1) Revenue |

| 2) EBITDA |

| 3) Relative TSR |

| 4) ROIC |

| 5) Employee Injury Rate |

| 6) Diversity, Equity & Inclusion |

| 7) Net Promoter Score |

Executive compensation “actually paid” can be defined as a type of “realizable” pay, as it considers vested pay and the current value of potential future vesting opportunities from outstanding and unvested awards. Based on the SEC’s rule, the calculation of compensation “actually paid” is summarized below.

Calculation of Compensation Actually Paid Based on Adjustments to Total Pay from the SCT:

An illustration of what a new pay versus performance table might look like is shown below:

Illustrative Pay Versus Performance Table (2018 – 2022)

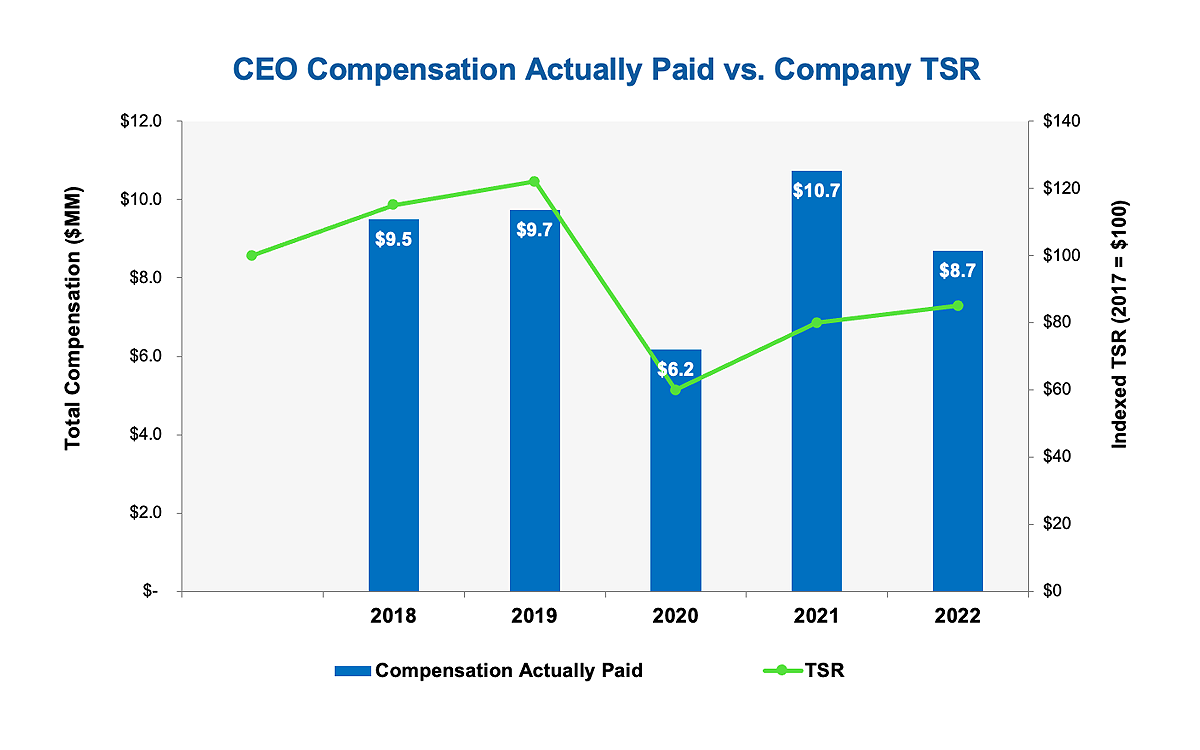

Companies are required to explain in a narrative and/or graphical format the relationship between CEO and NEO pay versus each of the performance metrics in the table as well as the relationship between company TSR and peer TSR. An illustrative example of how a company may show the relationship between CEO compensation actually paid and their company’s TSR is shown below. This type of graph can be repeated for the other relationships between pay and performance measures, and it can be accompanied with narrative text that provides greater explanatory detail. The SEC allows companies to determine how best to display this information, so we can expect there to be wide variability in how companies choose to comply with this part of the rule.

Addressing Apparent Pay Versus Performance Disconnects

The final rules have the potential to present information that can be misleading or can show an apparent pay versus performance disconnect for the CEO and the other NEOs. In 2015, Farient Advisors submitted comment letters to the SEC that provide feedback on the proposal and summarized ways the rule could mislead investors. Despite changes in the final rule that addresses various concerns from the 2015 proposal, some issues still remain that could distort investors’ view of pay and performance alignment.

For example, compensation actually paid does not align pay and performance time horizons. While the SEC rule includes the value of vested equity and changes in value of granted and outstanding equity over a five-year period, it evaluates pay on a year-over-year basis. A longer calculation of pay that matches with the performance or vesting periods of equity (e.g., three or four years, typically) would better match pay and performance time horizons and help remove the volatility in pay values caused by episodic one-time events. The mismatch present under the final rule will likely create situations in which one-year pay values do not track with performance.

These and other issues can be addressed and clarified by companies through their proxy disclosure. Companies can use the proxy to elaborate on how pay and performance are linked or why certain years of disclosure might be anomalous. Similar to the CEO Pay Ratio rules in which companies augmented required disclosures to provide more color through additional text, data, or graphics, companies will need explore whether additional disclosures may be relevant for them in the context of the new pay versus performance rule.

Action Items

Now that the SEC rule is final and the 2023 year is fast-approaching, companies and their Boards should consider the following steps:

- Collect the necessary equity and pension award data and calculate “compensation actually paid” for the company’s CEO and NEOs in accordance with the rules

- Mock-up the required table, as well as the narrative and any graphical disclosures

- Compile a list of the most important performance measures impacting 2022 executive pay outcomes, and begin working to identify the three to seven measures to list in the proxy

- Determine whether any supplemental data or explanations, in addition to those required by the SEC, should be included in the proxy disclosure

- Assess how this disclosure likely will fit into the proxy, and how explanations can be kept succinct

- Evaluate how the narrative can be used to improve investors’ understanding of the company’s executive pay programs

- Determine whether the disclosure is likely to affect investors’ views of the pay programs, and ultimately the company’s Say on Pay vote. If the impact is negative, determine whether and how best to engage with shareholders to explain the company’s pay versus performance linkage, or consider ways to modify program design if the linkage is not strong

Related Pay Versus Performance Content

The Farient Say on Pay Tracker monitors and aggregates Say on Pay results, providing a summary of SOP votes with easy-to-access and easy-to-read tables that contain all companies with SOP votes of <50% and 50-80%.

In The News: Financial Times – US investors rebel against high executive pay

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media