From Patchwork to Progress? SEC Roundtable Signals Shift in Executive Pay Disclosure

July 30, 2025

A landmark roundtable was convened on June 26th by the U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins to assess the efficacy of executive compensation disclosures. In opening remarks, Atkins called the current framework a “Frankenstein patchwork” of overlapping requirements, questioning whether they achieved their intended goals and, if not, how they should evolve.

While participants generally agreed that current disclosure rules deserve review, they disagreed significantly on the scope of such a review. Simplification and achieving value for the investors emerged as guiding principles. Farient CEO Robin A. Ferracone attended the roundtable in person, and Partner Marc Hodak watched the proceedings virtually. The firm submitted a comment letter advocating for targeted reforms—eliminating the CEO Pay Ratio, streamlining Pay vs. Performance (PvP) disclosures, and revising the Summary Compensation and Equity Tables to improve their utility. The question now is not whether the SEC will make changes, but how far the regulator will go. There is a real opportunity at this juncture to improve executive pay disclosures for the benefit of investors and issuers alike.

Roundtable Discussion Key Points

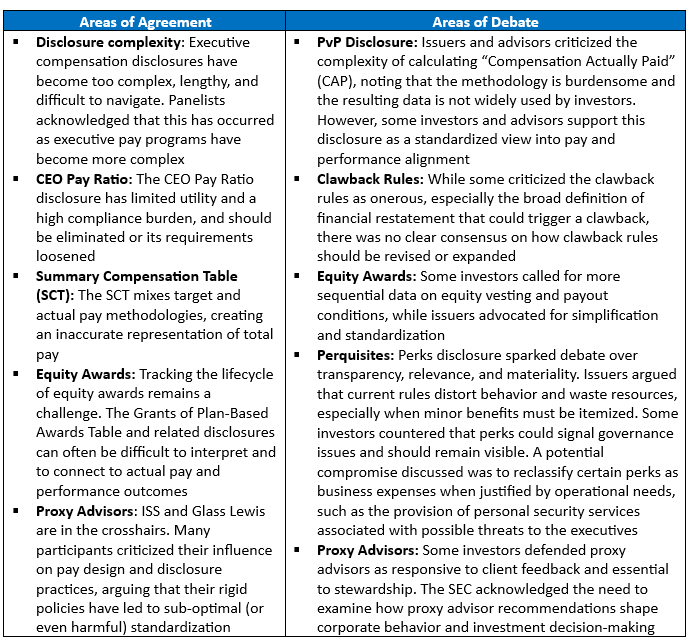

The roundtable revealed both consensus and contention across various areas.

Farient Recommended Enhancements

Farient believes the CEO Pay Ratio requirement should be dropped or minimized within the constraints of the law, given that it has generally not provided information of value to companies or investors, after eight years of reporting. (An act of Congress likely would be needed to rescind this, or any, Dodd-Frank requirement.)

The SEC, however, has leeway in implementing disclosure requirements, including the PvP and the equity pay tables. Below is a list of changes proposed to the rules around PvP, the SCT, and equity table disclosures Farient believes serve the dual purpose of simplifying the reporting and providing clearer and better information for investors.

Simplify Pay vs. Performance

The PvP disclosures are intended to facilitate evaluation of whether executive pay is effectively aligned with company performance. This disclosure centers on a pay measure called “Compensation Actually Paid” (CAP), which tracks the year-to-year change in realized and realizable pay. Suggested changes include:

- Remove average Named Executive Officer (NEO) columns, as NEOs can change year-to-year

- Remove the Net Income column, as GAAP net income can fluctuate due to accounting distortions that break any P4P link

- Make the company-selected measure optional, rather than required

- Remove the requirement to discuss the relationship between CAP and financial measures (while keeping the CAP vs. TSR discussion requirement)

- Encourage discussion of how plan design changes lead to alignment or misalignment in CAP and TSR

Improve Upon the SCT and Equity Tables

These tables aim to provide investors and other stakeholders with a transparent view of the cost of top executives to their firms. They help clarify how equity awards are structured, including how they pay out over time. Suggested changes include:

- Show both target and outcome values in the SCT table, or separate target vs. outcomes into separate tables

- Modify rules for the definition of perquisites so that personal security qualifies as a business expense, rather than a perquisite, if there is a valid security risk or business purpose to safeguard key employees

- Combine equity tables into a single table that shows their life cycle, including:

- Target grant-date intended value

- In-progress realizable value for outstanding awards

- Actual/realized value for completed awards, including the % of target earned

What Comes Next

The SEC continues to solicit feedback on potential changes to executive compensation disclosure through an open comment period. The Commission has signaled it will prioritize reforms that enhance clarity and usability without compromising transparency.

Companies, investors, advisors, and other governance professionals should offer proactive input for the disclosure standards they support. We do not yet know where the SEC will land. Still, as the agency moves from discussion to action, the governance community will play a critical role in shaping a disclosure regime that is both effective and sustainable.

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media