Farient Analysis: Glass Lewis Revamps Its P4P Model

September 9, 2025

An overhaul of Glass Lewis’s (GL’s) quantitative Pay for Performance (P4P) model will alter how the proxy advisor determines its Say on Pay (SOP) voting recommendations for annual shareholder meetings beginning in 2026. Whether the new methodology results in significantly different SOP outcomes remains to be seen. Farient’s analysis led to questions and recommendations for boards—the focus of this article—but first, a recap of key changes.

Key Changes

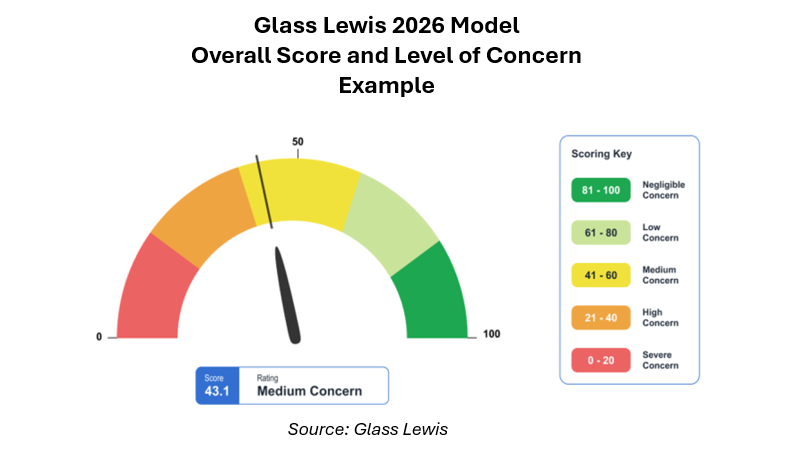

Scoring System: One of the most significant updates is the change from an A to F letter grade system to a 0 to 100 numerical score. With the new system, a lower score indicates greater concern, and the final concern level will range from Negligible Concern (Score of 81-100) to Severe Concern (Score 0-20).

A “Severe” concern will not mean an automatic “against” SOP recommendation. As before, GL will conduct a qualitative review and assess any mitigating factors to determine its final recommendation. How the individual test results will be combined to produce the overall score remains unknown.

Time Horizon: Tests will be based on a five-year assessment period rather than the current three-year period, and with a minimum time horizon of three years.

Tests: Instead of a single test comparing CEO and NEO granted pay with TSR and financial performance, the new assessment comprises five quantitative tests and a qualitative scorecard.

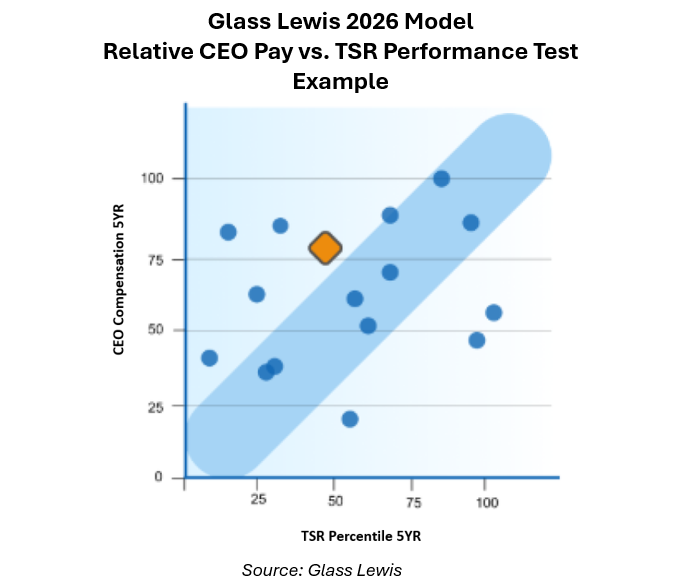

- Test 1: Relative CEO Granted Pay vs. TSR compares the relative rank of CEO granted pay vs. the company’s relative TSR rank as compared to GL’s defined peers over a five-year period. This test is a carryover from the current model and is similar to ISS’s relative degree of alignment test, except that it measures pay and performance over five years, not three

- Test 2: Relative CEO Granted Pay vs. Financial Performance compares the relative rank of CEO granted pay vs. the company’s relative financial performance rank as compared to GL’s peers over a five-year period

All companies will be assessed on revenue growth, ROA, and ROE. Depending upon the company’s sector, other measures could include:

– Banks/Financials/Mortgage REITs: EPS growth and Tangible Book Value Per Share (TPVPS) growth

– Most Equity and Specialized REITs: Funds From Operations (FFO) growth and Operating Cash Flow growth

– All Other Sectors: EPS growth and Operating Cash Flow growth

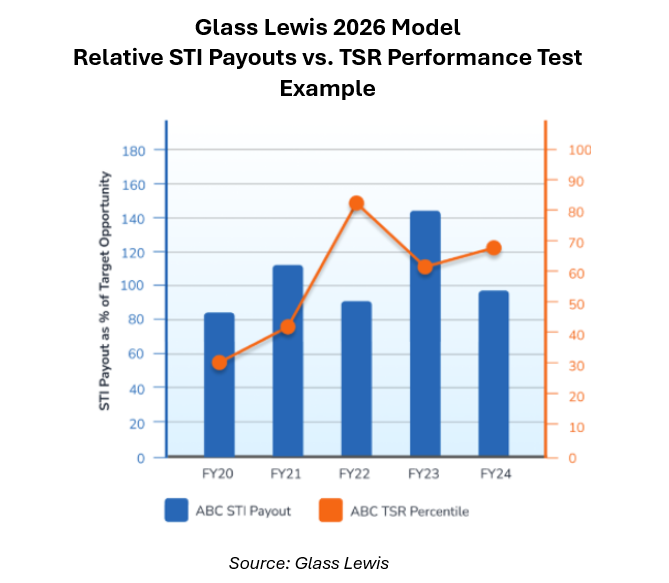

- Test 3: Relative CEO STI Payouts vs. TSR compares the rank of STI payouts as a percent of target to the company’s relative TSR rank vs. broad market benchmarks over each of the last five years. GL will apply a penalty when the STI payout is above the market median and the TSR is below the median

- Test 4: Relative NEO granted Pay vs. Financial Performance compares the relative rank of NEO granted pay vs. the company’s relative financial performance rank as compared to GL’s peers over a five-year period. This is similar to Test 2, but it uses NEO pay (excluding the CEO)

- Test 5: CAP-to-TSR Ratio (U.S.) calculates a ratio of five-year aggregate CEO Compensation Actually Paid (CAP), as disclosed, vs. five-year TSR and compares that ratio to GL’s peers based on market capitalization. A poorer score is generated if the CAP-to-TSR ratio is well above the peer median ratio (i.e., ≥150% of the peer median)

Qualitative Scorecard (U.S. and Canada):

- The qualitative scorecard will impact GL’s overall assessment based on answers to each of the following questions:

- Were any one-off awards granted?

- Was upward discretion [on incentive payouts] exercised?

- Is fixed pay greater than variable pay?

- Are incentives unlimited, or are limits not disclosed?

- Is the maximum LTI payout excessive? (unclear what is considered “excessive”)

- Is there a short vesting period for LTIs?

- Are any performance goals not disclosed?

Peer Group: GL will continue to use its proprietary model to build custom peer groups for the tests. However, two tests will use different benchmarks – the STI Payouts vs. TSR test (Test 3) will use broad market benchmarks, and the CAP-to-TSR Ratio test (Test 5) will use a benchmark of peers based on market capitalization.

Market Coverage: As part of this model update, GL is expanding its P4P assessment to the U.K., Europe, and Australia, in addition to its current coverage in the U.S. and Canada.

[Note: Please refer to the article from Southlea, our GECN Group partner in Canada, for more details on the implications for Canadian companies. Link: https://www.southlea.com/glass-lewis-announces-new-pay-for-performance-methodology/]

Unanswered Questions

Will the model changes matter? While this is a significant overhaul of the P4P model by GL, and we know the outputs will look different from before, it remains to be seen whether this means a fundamental change in GL’s “For” and “Against” SOP recommendations. GL may have simply created a model that quantifies its historical approach to SOP reviews. Moreover, we do not know to what extent GL will use its new P4P model to guide its SOP recommendation, or if it will rely more on its qualitative review.

Why is GL continuing to use a granted pay definition? Using a granted pay definition to assess pay and performance alignment is an inherently flawed approach. The granted value of pay generally reflects target, not realized (i.e., performance-adjusted) pay, and therefore is generally insensitive to performance. P4P alignment is effectively determined by using realized or realizable definitions of pay. However, GL is incorporating measures of STI payouts and CAP vs. performance, which is a step in the right direction.

How, specifically, does the model work? GL has yet to release a detailed methodology for its new model, so specific parameters remain unknown. For example:

- How will the tests be combined into an overall score?

- How will individual years be weighted?

- How will financial performance measures be weighted?

- Will there be defined thresholds for concern on each test?

- What will happen when CAP is negative?

- How will companies with no STI targets be handled?

How will a five-year time horizon impact GL’s assessment? GL’s new five-year time horizon has not previously been used by either GL or ISS for relative P4P tests. Under a longer time period, pay and performance comparisons can become unwieldy, especially if companies change leadership, restructure, or peer groups. While institutional shareholders will likely welcome this longer-term perspective, it could introduce significant noise in the data, making it more difficult to draw conclusions.

Is GL attempting to gain relevance vs. ISS on P4P and SOP? GL is likely aware that its SOP recommendations, at least in the U.S., generally have less of an impact on SOP results than the recommendations of its chief rival, ISS (see Farient’s What Happens When Proxy Advisors Say No To Executive Compensation?). With ISS having made only minor changes to its P4P model over recent years, GL may see an opportunity to get ahead of ISS by updating its model, incorporating new data (e.g., CAP data from PvP), and taking a longer-term perspective (i.e., five years instead of three).

Is GL using the changes to grow its corporate arm? Issuers subscribe to GL’s web services that include simulating the P4P model results. By making changes to the model and arguably making it more complex, companies and their advisors have an incentive to subscribe to GL’s corporate services.

Farient’s Analysis: Recommendations

Farient suggests that companies take steps to assess the potential impact of GL’s new P4P model, including:

- Determine which of your investors rely on GL to inform their voting decisions and the percentage of shares that will be affected. Understanding this will help determine how much time to devote to GL’s model updates

- Review the model changes to determine if there are areas of concern for your company. While methodologies are not yet fully known, questions companies can begin to tackle include:

- How do CEO and NEO pay over one-year and five-year periods compare with those of GL peers for your company?

- Where does the company rank on TSR and financial performance vs. GL peers over these time periods?

- How do STI payouts as a percent of target compare to one-year TSR and the broader market?

- What is the ratio of CAP to TSR? How does that compare to the market?

- Will the company be flagged for any of GL’s qualitative scorecard measures?

- Simulate the GL results once methodology specifics are released

- Prepare for more robust disclosures if you anticipate needing to address P4P alignment concerns. For example, your company may need to explain the impact of changes in executive leadership (CEO changes in particular) or the impact of company recapitalizations or restructurings

- Develop shareholder and proxy advisor engagement strategy. Depending on the situation, engage with shareholders and proxy advisors to understand their views, explain your company’s compensation program, and tell your company’s P4P alignment story

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media