Larry vs. Larry: Oracle CEO Pay vs. Google CEO Pay

December 19, 2013

There are a number of similarities between Oracle and Google. Both are founder-led companies. Both are icons of technology. Both are highly successful. But when it comes to executive compensation, that’s when the similarity ends.

On October 31, 2013, Oracle failed its Say on Pay (SOP) vote, garnering only 43 percent support from shareholders. And this was on the heels of only 41 percent support in 2012. In 2013, Oracle’s CEO, Larry Ellison, received just under $70 million in Performance-Adjusted Compensation™ (PAC™), making him one of the highest paid CEOs in the world.

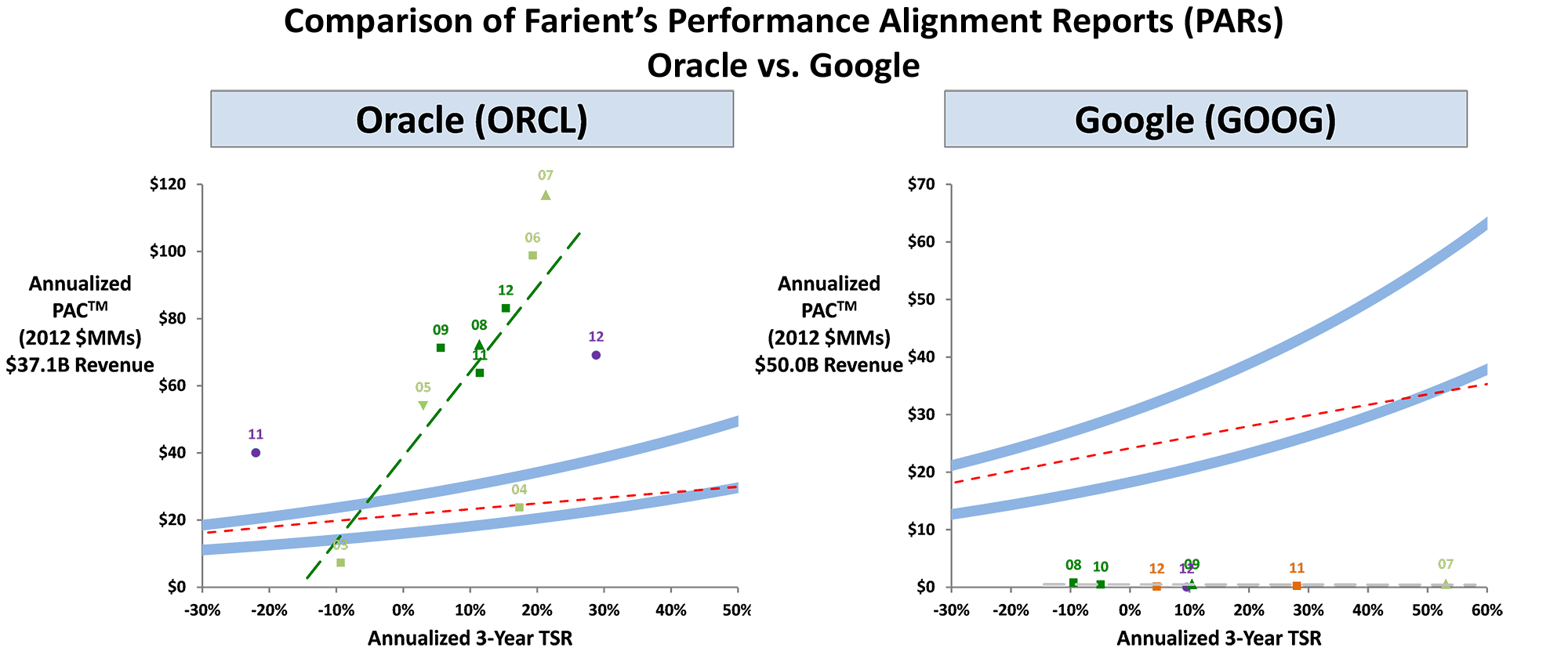

Farient Information Services maintains an Alignment Model which shows whether CEOs are paid appropriately for their company’s size, industry and performance. In other words, the Model shows whether Ellison’s pay is justified by his performance. As shown in Oracle’s Alignment Model below (click to expand), Larry Ellison’s pay has indeed been outsized relative to the company’s size, industry and performance.

In contrast, Google’s shareholders gave the company a 98 percent approval rating in 2011, the first and only time Google has had its triennial SOP vote. Why? Because Google’s CEO, Larry Page, received only $1 in PAC in 2013 and an average $600,000 over 2011-2013. Although my 2011 blog, “Beware of the $1 a Year CEO”, may be a cause for concern, Farient’s Alignment Model indicates that Page’s compensation barely registers on the chart compared to most other CEOs running companies in Google’s size range and industry. Given this pattern, I would expect to see a similar SOP result for Google in 2014.

Interestingly, the two extremes of Larry vs. Larry both are borne by the same phenomenon: both CEOs hold enormous amounts of wealth in their company’s equity and wield influence over how they are compensated. Ellison owns a 24 percent stake in Oracle worth nearly $40 billion whereas Page owns a 7 percent stake in Google, worth about $25 billion. However, both CEOs use their influence differently when it comes to their own pay. At Oracle, Ellison uses his influence to garner outsized compensation. At Google, Page uses his influence to take little to no compensation.

Our experience with founder-led companies is that executive and shareholder interests are, more often than not, closely aligned. Examples include Jeff Bezos of Amazon, Steve Ballmer of Microsoft and Jim Sinegal (recently retired) of Costco, all of whom take below market compensation. However, on the other hand, we sometimes see the opposite effect. Examples include Mike Jeffries of Abercrombie & Fitch, Steve Ells of Chipotle and Eugene Isenberg (recently retired) of Nabors Industries.

Clearly, in the SOP contest of Larry vs. Larry, investors have cast their votes in favor of Page over Ellison, indicating once again that investors are usually good at recognizing a good deal when they see one.

Visit our Pay Tracker for daily Say on Pay vote results, and sign up for our e-newsletter to receive a weekly report showcasing how well (or not so well) companies have aligned their executive compensation with company performance.

This article originally appeared on Forbes.com.

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media