Beyond the Headlines – Executive Pay in the Pandemic Year

November 16, 2021

Executive Summary

- 2020 was a strong year for investors, following very robust equity returns in 2019

- Compensation decisions are made early in the fiscal year. For 2020 this meant compensation decisions were made prior to understanding the impact of COVID-19

- Because short-term incentive (STI) plans are awarded for past performance, 2020 STI plans paid out at lowest rate relative to target when considered over the past five years of payouts

- Overall executive pay did increase, driven by increase in LTI; however, the year over year increase declined as 2020 progressed

Introduction

For most of 2020 and into 2021, COVID-19 disrupted business plans, personal plans, and all plans in between. At Farient, we’ve continued to watch the impact on executive compensation and corporate governance as the pandemic has played out. Through our COVID Tracker, we have recorded adjustments to executive compensation plans as boards of directors tried to balance the needs of stakeholders while focusing their executive teams on addressing the various challenges faced in their industry.

As the proxy season wound down in April of 2021, numerous articles grabbed headlines as they highlighted the increase in executive pay despite the pandemic and its toll on stakeholders. You can read some of them here, here, and here. Our team at Farient wanted to dig deeper and get inside the “headline-grabbing numbers,” to better understand the underlying drivers for this highly publicized increase in executive pay.

In this Farient brief, we take a dive into the 2021 proxy season and the reported rise in CEO pay.

Single Number, Multiple Time Frames

Before diving into the numbers, we need to revisit the decision-making calendar of compensation committees and align that with the impact of the pandemic. For the most part, the business media is using the total compensation figure reported by companies in their proxy statement. This total compensation figure is a mixture of past and future compensation paid out over different timeframes:

- Base Salary: Earned and paid out over the course of the year

- Short-term Incentives (STI) and Bonuses: Including those paid as part of a performance plan are paid at the end of the fiscal year to recognize that year’s financial and/or individual performance

- Long-term Incentives (LTI): Equity and stock options are granted and reported as part of a single year’s compensation, but don’t generally vest for at least three years

These are important considerations as we frame board decisions around these awards to the various events of the pandemic. In our experience, compensation committees often determine compensation at the beginning of their upcoming fiscal year. LTI grants, which make up the vast majority of executive compensation, are made in February or early March for the majority of companies, taking into account performance from the previous year. In 2020, boards of directors, looking back to the performance of 2019, clearly made these grants before the impact of the pandemic was fully understood.

2020 Compensation, 2019 Performance

Despite a volatile market, investors did well in 2020. The median S&P 500 company returned 10.1%. This pales in comparison, however, to the shareholder returns in 2019, when the median S&P 500 company returned 30.6% which was the baseline as boards of directors made go-forward compensation decisions in early 2020.

Payouts Aren’t What They Used to Be

When we examined companies in the S&P 500 which had the same CEO for all of 2019 and 2020, we found that the median total direct compensation remained essentially flat. This, however, belies changes in the underlying pay components. The median payout of STI bonus plans for fiscal year 2020 was at a five-year low, paying 100% of target. For the past four years, median payout ranged between 113% and 125% of target.

During 2020, some CEOs chose to take reduced salary or no salary at all. Interestingly, a decrease in STI payouts (the median STI award shrank by $700,000) was offset by growth in LTIs. The median LTI grant grew to $8.6 million up from $8 million in 2019, a 7.5% increase year over year.

Let’s drill down on this. Did companies that granted their LTI later in the year consider the impacts of COVID on their business? First, we analyzed the timing of grants and found that companies did not delay the granting of equity in 2020 relative to previous years. What we did find, however, was that the year-over-year increases in LTI grants declined as the year progressed. In Q1 and Q2 of 2020, the median LTI grant grew by 7.5% as compared to the 2019 grant, whereas in Q3 and Q4, LTI grew 4.1% and 2.8%, respectively, with the acknowledgment that the sample sizes for companies granting later in the year were significantly smaller than earlier in the year.

Conclusion

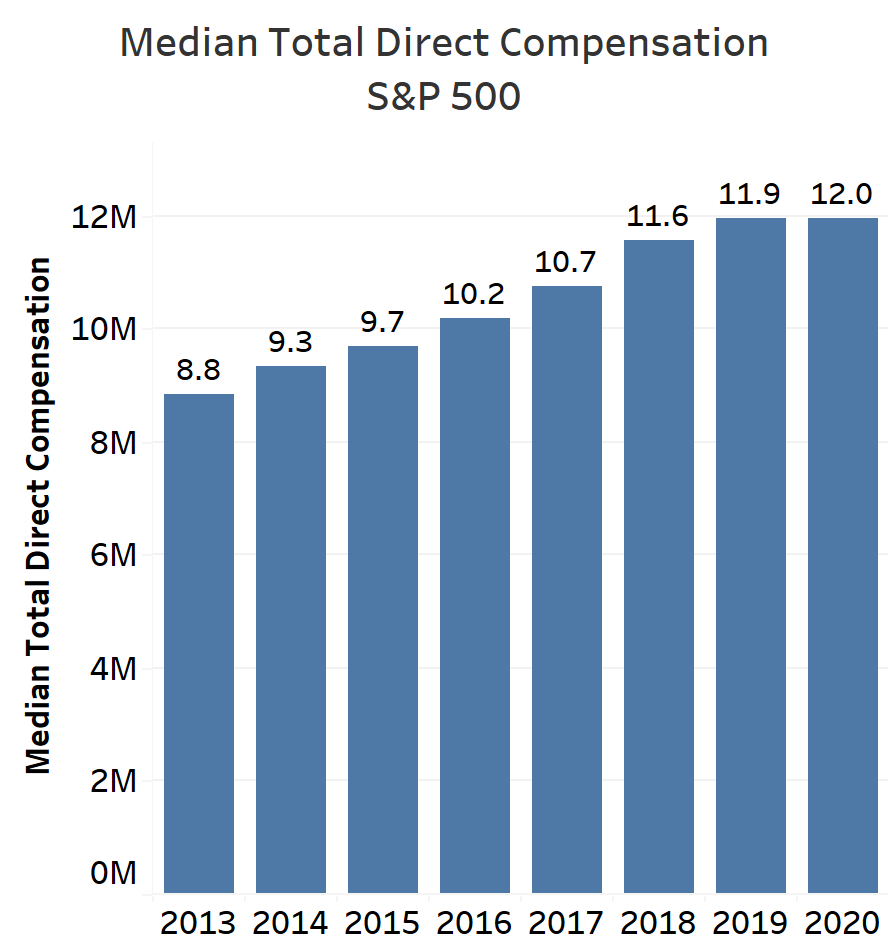

Executive compensation continues to be a headline-grabbing lightning rod. To that end, we often see compensation referenced as an example of pay disparity and cited as one cause of widening wealth inequality. Clearly, executive pay has continued to rise over time and at a much faster rate than the pay of those below the C-suite. COVID impacted industries differently. It’s no secret that hospitality and travel took a beating while businesses that could quickly and efficiently move online were the victors.

That being said, our research supports the idea that boards of directors slowed the growth of payouts later in 2020 in response to the pandemic. The real test will come in early 2022 when early 2021 pay decisions are disclosed in proxy filings. The decisions made in early 2021 will have been made with full knowledge of the impact of COVID-19 on the business as well as employees, suppliers, and communities. We’ll be watching to see how directors and executives have made compensation decisions in the full context of the pandemic.

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media