New Guidance from Big Investors, Proxy Advisors Shows Commitment to ESG Goals

March 21, 2023

As US companies prepare for this year’s proxy season, which includes complying with new SEC Pay vs. Performance and clawback rules, investors gear up to review executive pay programs through the lens of their proxy voting guidelines and stewardship policies—policies that change every year. As a result, an executive pay program not aligned with the policies of the company’s largest investors may lose significant shareholder support and risk failing its Say-on-Pay (SOP) vote.

2023 Policy Highlights

Large institutional investors have begun releasing their proxy voting guidelines and stewardship policies for 2023. BlackRock, for instance, made minor changes to its policies and noted it does not expect material changes to its voting, with much of its engagement with companies “continuing the dialogue on material risks and opportunities” that it had in 2022. Its engagement priorities will continue to be in five key categories:

1) board quality and effectiveness

2) strategy, purpose, and financial resilience

3) incentives alignment with value creation

4) climate and natural capital

5) company impacts on people

Notably, BlackRock’s priorities continue to focus on ESG-related topics with a particular callout on executive incentives. BlackRock notes that it expects a clear link between variable pay and a company’s operational and financial performance. Additionally, BlackRock states that if ESG-based incentives are used, they need to be as rigorous as other financial or operational targets, which is consistent with guidance provided in 2022.

Glass Lewis, ISS, and Proxy Advisors also released their proxy voting guidelines, including compensation policies. Changes for 2023 from ISS and Glass Lewis include enhanced assessments of off-cycle incentive awards, large equity grants (“mega grants”), overly complex incentive plans, the use of committee discretion on incentive payouts, and board responsiveness to prior low SOP votes.

ISS also clarified that shareholder proposals for ESG metrics in compensation would be assessed on a case-by-case basis depending on their scope, the company’s current level of disclosure on environmental and social (E&S) performance and governance (G), and any history of E&S controversies or regulatory violations. And similar to BlackRock’s policy on ESG incentives, ISS clarified that it considers the company’s compensation committee to be in the best position to determine the metrics in the compensation program, while at the same time affirming that improved disclosure may benefit shareholders.

ESG and Compensation Overlap

As evidenced by the current investor and proxy advisor policies, the convergence of ESG and compensation plans continues. Investors are now using executive compensation and SOP votes to push for sustainability-aligned strategies and performance. Further, they are encouraging companies to design compensation programs in consideration of broader stakeholder expectations. (See related research: 2023 Global Trends in Stakeholder Incentives: The Staying Power of ESG.

Large investors, in particular, are demanding that companies adopt sustainability strategies and targets, diversify their boards, and disclose ESG information. A more recent development, however, has been the investor’s role in driving the incorporation of stakeholder measures into incentive plans.

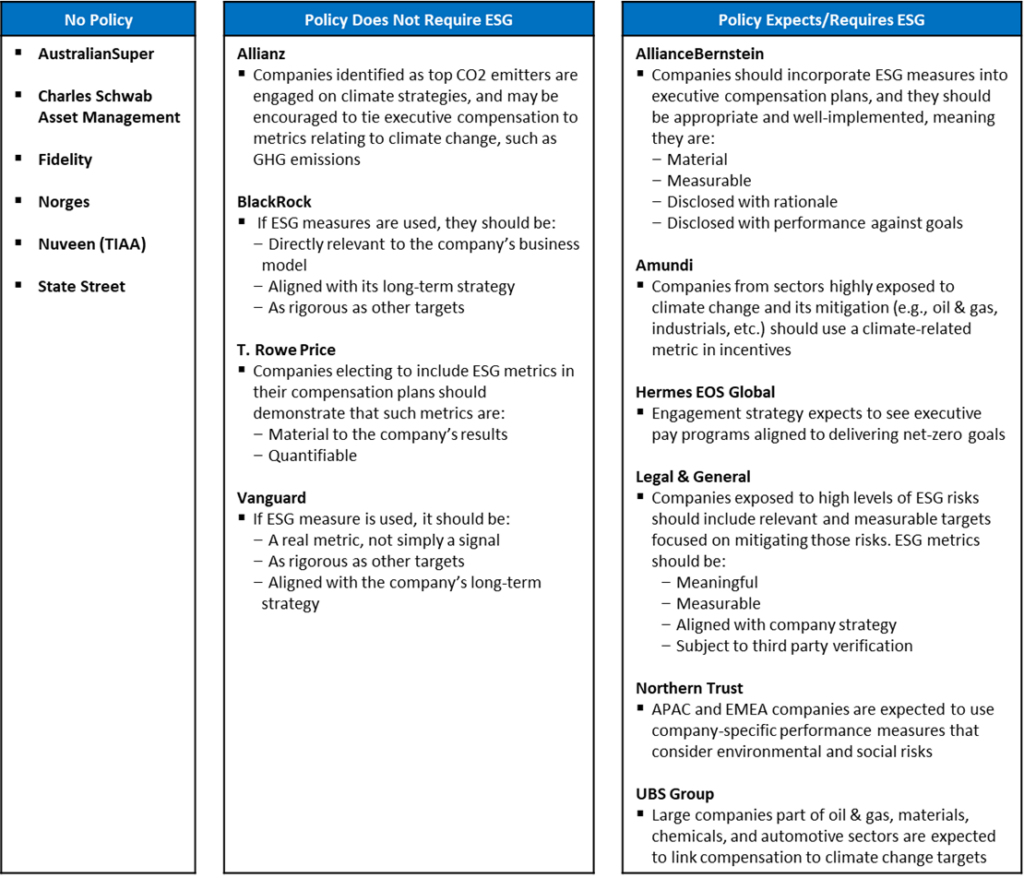

While many investors do not have a formal policy on incorporating ESG measures into compensation plans, some of the largest asset managers have released specific policies on their expectations. BlackRock and Vanguard, for example, are pushing companies that use stakeholder measures in incentive plans to prove that they have the same level of goal rigor as that used for other financial and non-financial metrics.

Meanwhile, other global investors such as AllianceBernstein, Legal and General, Allianz, Amundi, and UBS have engagement policies that encourage the adoption of stakeholder incentive measures, and particularly climate measures for companies in certain industries. It should be noted, however, that some of these investors are not asking for a pay connection to all ESG goals. In fact, some investors are making the linkage to only a part of the “E,” such as climate targets.

Farient’s Point of View

Investor pressure will continue to force more companies to strengthen their ESG metrics and goals. As analyzed in our 2023 Global Trends in Stakeholder Incentives research, companies are increasingly migrating from only qualitative or “soft” stakeholder measures to more quantitative goals. For example, a company that may have used disclosure of GHG emissions as an activity-based goal in a prior year may be switching to a quantitative GHG emissions reduction goal in its new incentive plan design, thus building upon prior efforts to disclose data and establish baselines.

Each proxy season invariably reveals much about the shifting preferences of investors and proxy advisors. This year will likely show how companies respond to the growing chorus of highly political ESG critics. What remains certain, however, is that companies and their boards will need to adopt more rigorous and transparent processes to establish performance targets that align with executive compensation.

ESG Compensation Policies Among Select Global Investors

Source: 2023 Global Trends in Stakeholder Incentives: The Staying Power of ESG

By Brian Bueno

About Farient Advisors

Farient Advisors LLC is an independent premier executive compensation, performance, and corporate governance consultancy. Farient provides a full array of services, linking business strategy to compensation through a tailored, analytically rigorous, and collaborative approach. Farient has locations in Los Angeles, New York, Louisville, and Dallas and works with clients globally through its partnership in the Global Governance and Executive Compensation Group (GECN). Farient is a certified diverse company and is recognized by the Women’s Business Enterprise National Council.

© 2025 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media