Insights

A Collection of News, Views, and Resources

Filter by:

In the News

Say-on-Pay Support Stays Steady and Other Lessons from the 2025 Proxy Season—IR Impact

The 2025 proxy season confirmed several steady trends in executive compensation, while also revealing shifts boards will need to navigate in the years ahead. Say-on-Pay (SOP) support held strong across the Russell 3000, but concerns around special awards, mega-grants, and pay-for-performance alignment continued to drive the few failed votes. At…

Read More > 09.15.2025

In the News

Opendoor Brings Back Founders and Welcomes New CEO—Fortune

Opendoor Technologies is making headlines with the appointment of former Shopify COO Kaz Nejatian as CEO and a compensation package that could net him nearly $2.8 billion if he meets ambitious stock price targets. The deal underscores the company’s “founder mode” strategy, with co-founders Eric Wu and Keith Rabois returning…

Read More > 09.12.2025

In the News

CHROs Stay Put Longer as They Increasingly Become Strategic Assets—Agenda

Chief Human Resources Officers (CHROs) have remained in their roles longer than at any point in the past seven years, according to new reporting from Agenda. The trend reflects a shift in how boards view the CHRO function: No longer limited to HR operations, these leaders are now central to…

Read More > 09.09.2025

In the News

Thinking About Trimming PSUs from Your CEO’s Pay? Not So Fast—Agenda

Performance share units (PSUs) are under renewed scrutiny, with critics questioning whether boards set goals that are too easy to achieve. Still, new research suggests most investors aren’t ready to abandon them. A survey of more than 100 large investors found that 71% favor continuing to use PSUs, and 86%…

Read More > 09.03.2025

In the News

Why Some Boards Backtrack on Chair Independence—Agenda

More than 400 Russell 3000 and S&P 500 companies have recombined the roles of board chair and CEO after previously separating them, according to Agenda. The shift underscores a growing tension between shareholder calls for independent oversight and boards’ preference for unified leadership, efficiency, and CEO retention. Offering Farient’s perspective,…

Read More > 08.25.2025

In the News

The Hidden Costs of Firing the CEO—Bloomberg on YouTube

When a CEO is shown the door, the true price extends far beyond a severance check. Drawing on Farient Advisors’ data and analysis, Bloomberg’s YouTube video below explores the financial and governance fallout of high-profile CEO transitions — from “make-whole” stock awards and retention…

Read More > 08.21.2025

In the News

The Ballooning Cost of a CEO’s Exit—Bloomberg’s Big Take Podcast

How much does it really cost when a CEO is shown the door? Bloomberg’s Big Take podcast unpacks the financial and governance ripple effects of executive ousters — from multimillion-dollar severance deals to retention bonuses and “make-whole” payments. Reporter Matthew Boyle, who spoke with Farient Advisors and cited its data…

Read More > 08.21.2025

In the News

The True Cost of Firing a CEO—Bloomberg

Farient Advisors’ expertise and data analysis is featured throughout Bloomberg’s deep dive into the rising costs of CEO ousters. From multimillion-dollar severance packages and make-whole stock awards to retention bonuses and seven-figure adviser fees, the story shows how quickly expenses can mount when boards replace a chief executive. Led by…

Read More > 08.20.2025

In the News

CEO Pay at Top US Companies Accelerates at Fastest Pace in Four Years—Financial Times

Financial Times reports that CEO pay for the S&P 500 surged 7.7% in 2024, with median packages climbing to $19 million. According to data from Farient Advisors, the jump marked the sharpest increase since 2021 and outpaced both inflation and wage growth for the broader U.S. workforce. Executives at companies…

Read More > 08.19.2025

In the News

Executive Pay Lessons From 2025—Financier Worldwide Magazine

Citing Farient Advisors’ data, Financier Worldwide magazine examines key takeaways from the 2025 North American proxy season and the priorities boards should consider for the year ahead. While say-on-pay support for Russell 3000 and S&P 500 companies remains strong—averaging close to 90%—companies falling below 80% often face increased investor…

Read More > 08.14.2025

In the News

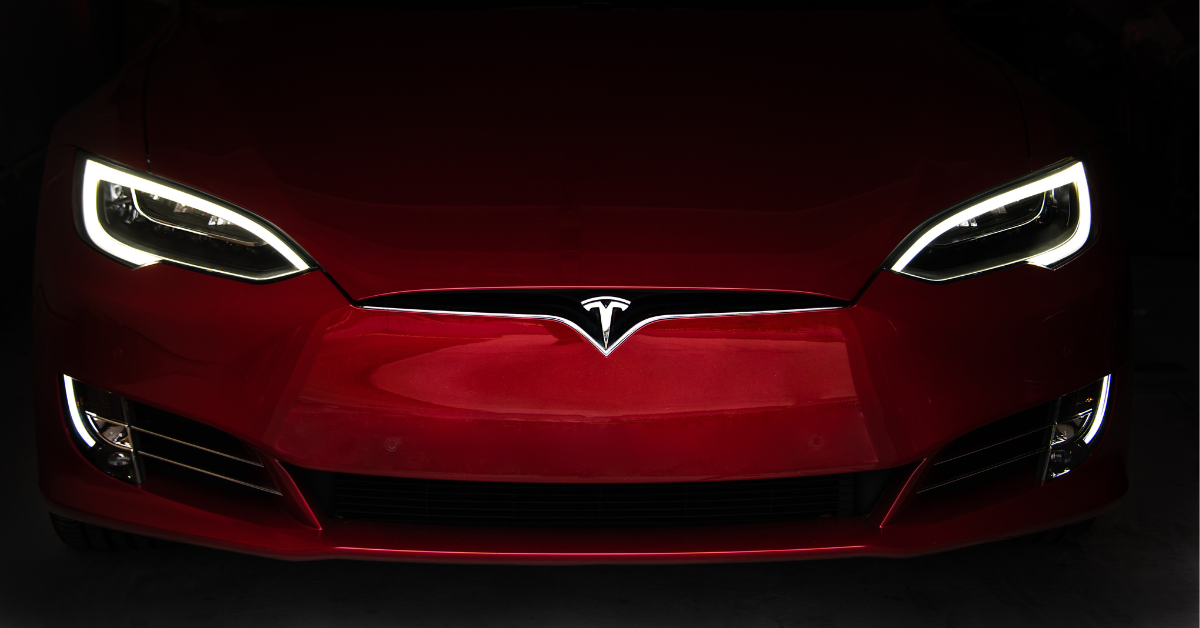

Elon Musk Retains Title as the Highest-Paid CEO in History—Fortune

Tesla has again cemented Elon Musk’s status as the highest-paid CEO in history, granting him a new $29 billion compensation package—now structured as 96 million restricted shares. The award comes after years of legal wrangling over his original 2018 mega-grant, which was twice struck down by Delaware courts. In…

Read More > 08.05.2025

In the News

Resistance Builds Against Performance Shares for CEOs—Agenda

A recent Agenda article highlights growing resistance to performance share units (PSUs) in CEO pay packages. While PSUs have long been favored as a way to align executive incentives with company goals, new research suggests they may not deliver the intended results. A study examining S&P 1500 firms found that companies…

Read More > 08.05.2025

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media