Insights

A Collection of News, Views, and Resources

Filter by:

Briefs

A Look Back at Compensation Committees’ Greatest Challenges

What a year it has been. Our world was beset by unthinkable humanitarian crises and wars likely to alter social, personal, and political proclivities for generations to come. It was a good year to refresh our thinking on all aspects of leadership beginning perhaps with Walter Bennis and Burt Nanus’s…

Read More > 12.12.2023

Briefs

Slice and Dice Company Data on New ESG Tracker™

No longer are we tracking whether companies are using ESG measures but how? Farient Advisors’ ESG Tracker™ now provides insights into executive incentive plans for all-size companies and industries. At this moment when it seems attention on ESG issues—both from proponents and opponents—is at an all-time high,…

Read More > 10.05.2023

Briefs

Turnover at the Top: Are Boards Ready?

Boards are facing a potentially daunting challenge: an upsurge in executive turnover that could deprive companies of vital, experienced talent at a time of pivotal change. That was the finding of a newly published survey of nearly 200 U.S. public company board members conducted by Corporate Board…

Read More > 09.21.2023

Briefs

Farient Advisors CEO Robin Ferracone Recognized As NACD Directorship 100 Honoree

Los Angeles, September 20, 2023 – Robin Ferracone, founder and CEO of executive compensation and corporate governance consultancy Farient Advisors, has been named to the annual National Association of Corporate Directors‘ 2023 NACD Directorship 100—the most influential peer-nominated…

Read More > 09.20.2023

Briefs

Making Every Summer Count

I have a love hate relationship with summer. By July, most of us are ready for a break, though traveling through the heat of summer amid crowds and inflated pricing has never been high on my list. What’s important to me is adventure and how to keep the adrenaline pumping.

Read More > 09.15.2023

Briefs

Ethics, Compliance, and the Role of Compensation

Fraud and other criminal or unethical activities can cause harm not only to corporate entities but to their shareholders, communities, and employees. When unethical business practices become engrained into corporate culture, they can bring down a whole sector or the entire economy. The sudden bankruptcy of the cryptocurrency exchange FTX…

Read More > 09.15.2023

Briefs

Proxy Season Recap: Nuanced Results for SOP, ESG Issues

The 2023 proxy season plugged along with more whimpers than roars. Most annual general meetings take place in public each year between January and June. Even though AGMs typically draw few shareholders, votes taken on proposals and director elections generate insights into the mood of investors—and as any seasoned director…

Read More > 08.30.2023

Briefs

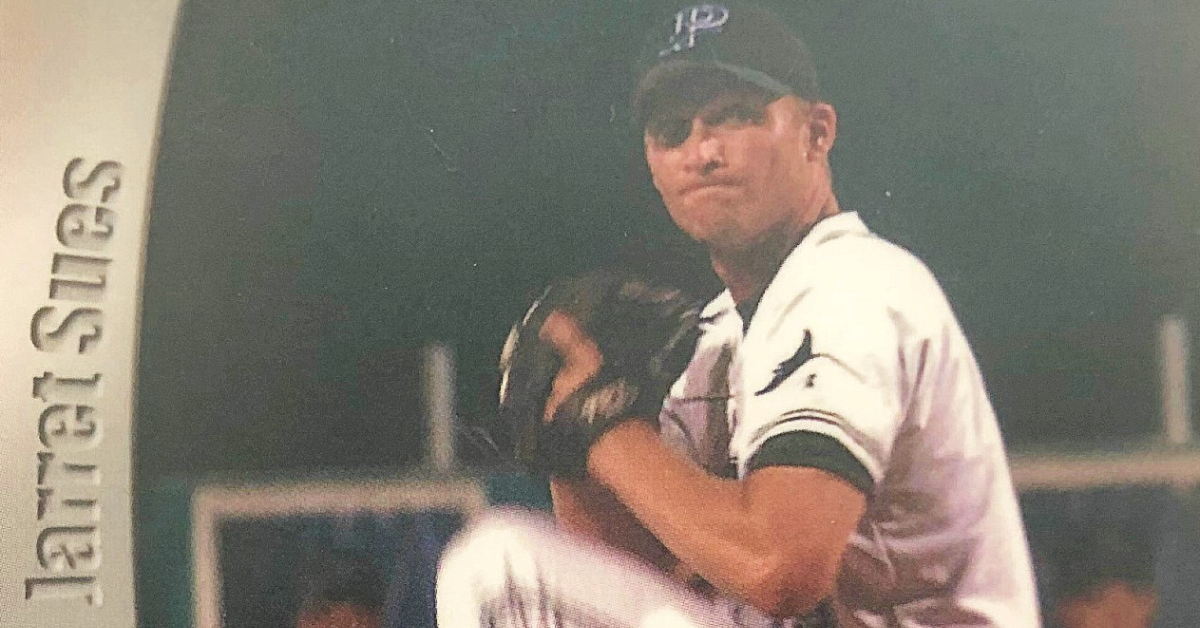

Jarret Sues: A Professional Team Player

On any given weekend, Jarret Sues can be found coaching or cheering on his 8- and 10-year-old sons in the sport of the season. He also is a devoted golfer and a lifelong bowler. In high school and at Ohio’s Xavier University, Sues was a standout baseball…

Read More > 08.28.2023

Briefs

Summer Escapes

Summer Escapes For your OOO escape: Elevate your leisure and indulge your intellect with the Farient team’s thoughtfully curated recommendations for what to watch, read, and listen to. During these dog days of summer, explore the virtual worlds our teammates are visiting in our second annual compilation.

Read More > 08.01.2023

Briefs

Jarret Sues Joins Farient as Partner

Jarret Sues Joins Farient as Partner Farient Advisors appointed Jarret Sues Partner, bringing his nearly two decades of compensation consulting experience to the firm’s growing team of high-caliber professionals. In his new role, Sues will provide clients with advisory services on the design, execution, and communication of…

Read More > 07.11.2023

Briefs

Compensation Expert Jarret Sues Joins Farient Advisors as Partner

New York, June 30, 2023—Farient Advisors, a leading independent executive compensation, performance, and corporate governance consultancy, today announced the appointment of Jarret Sues as partner. Sues brings nearly two decades of compensation consulting experience to Farient’s growing team of high-caliber professionals. In his new…

Read More > 06.30.2023

Briefs

The Keys to Impactful Executive Compensation Programs

The Keys to Impactful Executive Compensation Programs Connecting the dots: In this episode of ClimeCo’s ESG Decoded podcast, Farient founder and CEO Robin A. Ferracone shares the essentials of effective compensation programs with host Kaitlyn Allen. Conversations in boardrooms and committee agendas have changed. Workforce well-being, DEI,…

Read More > 06.15.2023

© 2026 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media