This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Insights

A Collection of News, Views, and Resources

Filter by:

Briefs

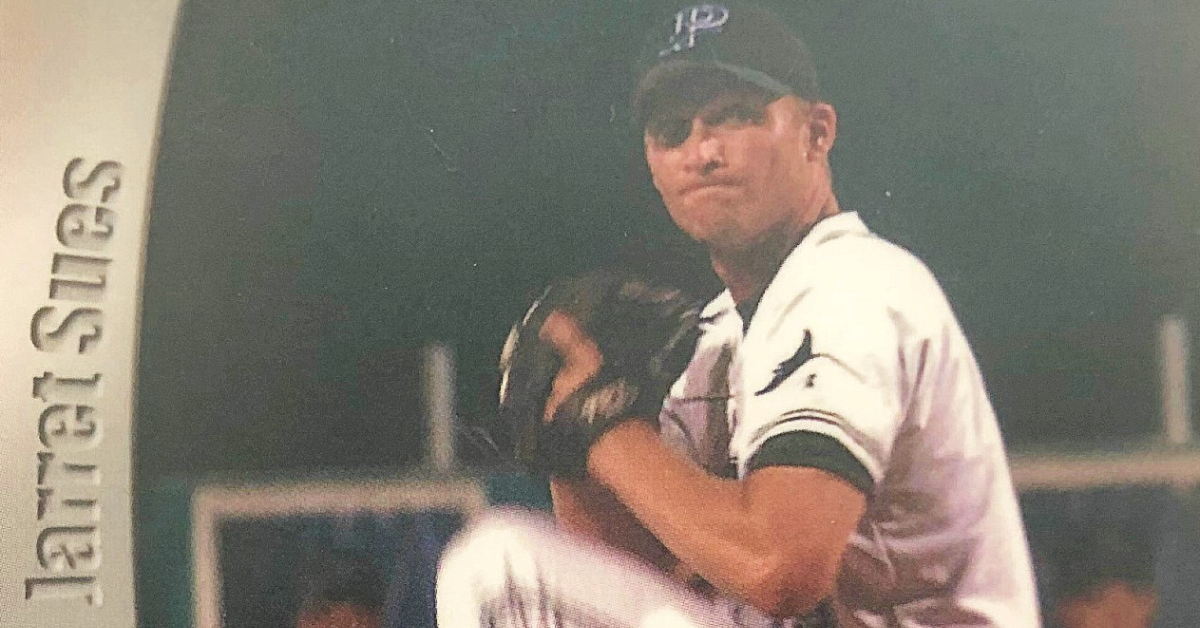

Jarret Sues: A Professional Team Player

On any given weekend, Jarret Sues can be found coaching or cheering on his 8- and 10-year-old sons in the sport of the season. He also is a devoted golfer and a lifelong bowler. In high school and at Ohio’s Xavier University, Sues was a standout baseball…

Read More > 08.28.2023

In the News

As Say on Pay Support Rises, New Concerns Loom—Agenda

A big story this proxy season has been the seeming turnaround on Say on Pay votes, with investors approving more compensation plans than last year, ending a multi-year decline. But what does it mean? This Agenda article sheds light citing data from Farient’s research team and insights from ESG Leader…

Read More > 08.21.2023

In the News

Shareholders ease pressure on CEO pay—Reuters

The continual decline in investor support for companies in Say-on-Pay votes has reversed this year, according to Farient data cited in this Reuters Sustainable Finance article. Some 70% of companies in the S&P 500 won support from at least 90% of votes cast on their executive compensation this year, up…

Read More > 08.16.2023

Briefs

Summer Escapes

Summer Escapes For your OOO escape: Elevate your leisure and indulge your intellect with the Farient team’s thoughtfully curated recommendations for what to watch, read, and listen to. During these dog days of summer, explore the virtual worlds our teammates are visiting in our second annual compilation.

Read More > 08.01.2023

Podcasts/Videos

Summer Escapes

August is a popular month to leave work behind for more leisurely pursuits. With that in mind, we bring you our second annual roundup of what to read, watch, and listen to. This list is based mostly on recommendations from our Farient colleagues. It aims to be neither comprehensive nor…

Read More > 07.26.2023

In the News

Reviewing the 2023 Proxy Season—Corporate Secretary

Two big trends have stood out this proxy season: a decline in shareholder support for ESG proposals and increased investor support for companies in Say on Pay votes. But rather than signaling investor retreat on holding companies to account, these may be a consequence of companies going in the right…

Read More > 07.12.2023

Briefs

Jarret Sues Joins Farient as Partner

Jarret Sues Joins Farient as Partner Farient Advisors appointed Jarret Sues Partner, bringing his nearly two decades of compensation consulting experience to the firm’s growing team of high-caliber professionals. In his new role, Sues will provide clients with advisory services on the design, execution, and communication of…

Read More > 07.11.2023

Briefs

Compensation Expert Jarret Sues Joins Farient Advisors as Partner

New York, June 30, 2023—Farient Advisors, a leading independent executive compensation, performance, and corporate governance consultancy, today announced the appointment of Jarret Sues as partner. Sues brings nearly two decades of compensation consulting experience to Farient’s growing team of high-caliber professionals. In his new…

Read More > 06.30.2023

In the News

Rampant Uncertainty as Comp Committees Take More Hits—Agenda

Comp Committees are struggling to keep up with a growing workload, says this Agenda article. But why? Farient Partner Marc Hodak offers one observed trend that accounts for a greater burden: more companies are enhancing oversight of human capital issues like talent and HR. This has led…

Read More > 06.26.2023

In the News

Exec Docked $200K Over Deleted Text Messages—Agenda

Clawbacks of executive pay over impropriety remain rare – and companies often are reluctant to disclose them outside the legally mandated end-of-year proxy. Not so with the recent clawback of the CMO’s pay at Church & Dwight, which was disclosed proactively to investors almost immediately. In this Agenda article, Farient…

Read More > 06.26.2023

In the News

ESG support falters this proxy season—Pensions & Investments

2023 proxy season has seen some notable trends, including a decline in investor support for ESG related shareholder proposals, and an uptick in investor support in Say on Pay votes. In this article for Pensions & Investments, Farient Partner Marc Hodak weighs in on both these trends, discussing how investors…

Read More > 06.26.2023

In the News

Executive at Arm & Hammer Maker Is Docked $200,000 Over Deleted Texts—Wall Street Journal

Clawing back executive pay over misconduct is rare and when it does happen it is typically disclosed at the end-of-year proxy statement as legally required. Not so with recent action by Church & Dwight, according to this Wall Street Journal article quoting Farient founder and CEO Robin…

Read More > 06.22.2023

© 2024 Farient Advisors LLC. | Privacy Policy | Site by: Treacle Media